Making sense of the markets this week: July 19, 2021

Inflation is likely to stick around for a while—here's how to deal with it. Plus, highlights from earnings season, and the disparity between earnings growth (big) and revenue growth (not so much).

Advertisement

Inflation is likely to stick around for a while—here's how to deal with it. Plus, highlights from earnings season, and the disparity between earnings growth (big) and revenue growth (not so much).

“Chief financial officers, on average, expect higher-than-normal cost increases to persist for eight to 10 months, according to a Duke University survey released Wednesday.

“Some worry inflation will linger longer. About one in four CFOs expect elevated costs to last through most of 2022.”

In the Duke survey, the vast majority of executives admitted they have passed along cost hikes to customers; any supply chain hits end up on the consumer’s bill. And business bosses believe that will continue well into 2022. (Duke’s survey also confirmed the business optimism we reported in last week’s column.) A recent U.S. report showed broad-based inflation levels at a 13-year high, increasing by 5.4% year over year. The core index, which excludes food and energy, rose 4.5% year over year, the biggest increase since November 1991. Labour shortages in the U.S. are also pitching in on increased costs to businesses—they have to increase wages to attract workers. Once again, those costs are often passed along to the consumer. That is called wage-push inflation, and it’s one of many isolated forces pushing on the inflation front. They can add up over time, creating more structural or long-lasting inflation that could be hard to unwind. So, transitory for longer might be more than the phrase of the week—but how much longer is anyone’s guess. But it appears likely that higher levels of inflation will be with us at least well into 2022. Let’s not forget the biggest risk is still the pandemic. It’s not over. And barriers to full vaccination could blunt or delay any economic recovery, and the global vaccination rate is still only in the 25% range. This week, bonds considered inflation and then had second thoughts:The bond market momentarily perked up and then went back to deciding yup, it's transitory. pic.twitter.com/rddO75K4yg

— Lisa Abramowicz (@lisaabramowicz1) July 13, 2021

“[F]orecasts have drifted higher in recent months, helped by an unusually large number of companies advising investors that they expect earnings to come in higher than analysts had been estimating.

“‘The reason for that is simple: The speed and robustness of the recovery is greater today than everyone anticipated three months ago,’ said Hal Reynolds, chief investment officer at Los Angeles Capital Management.”

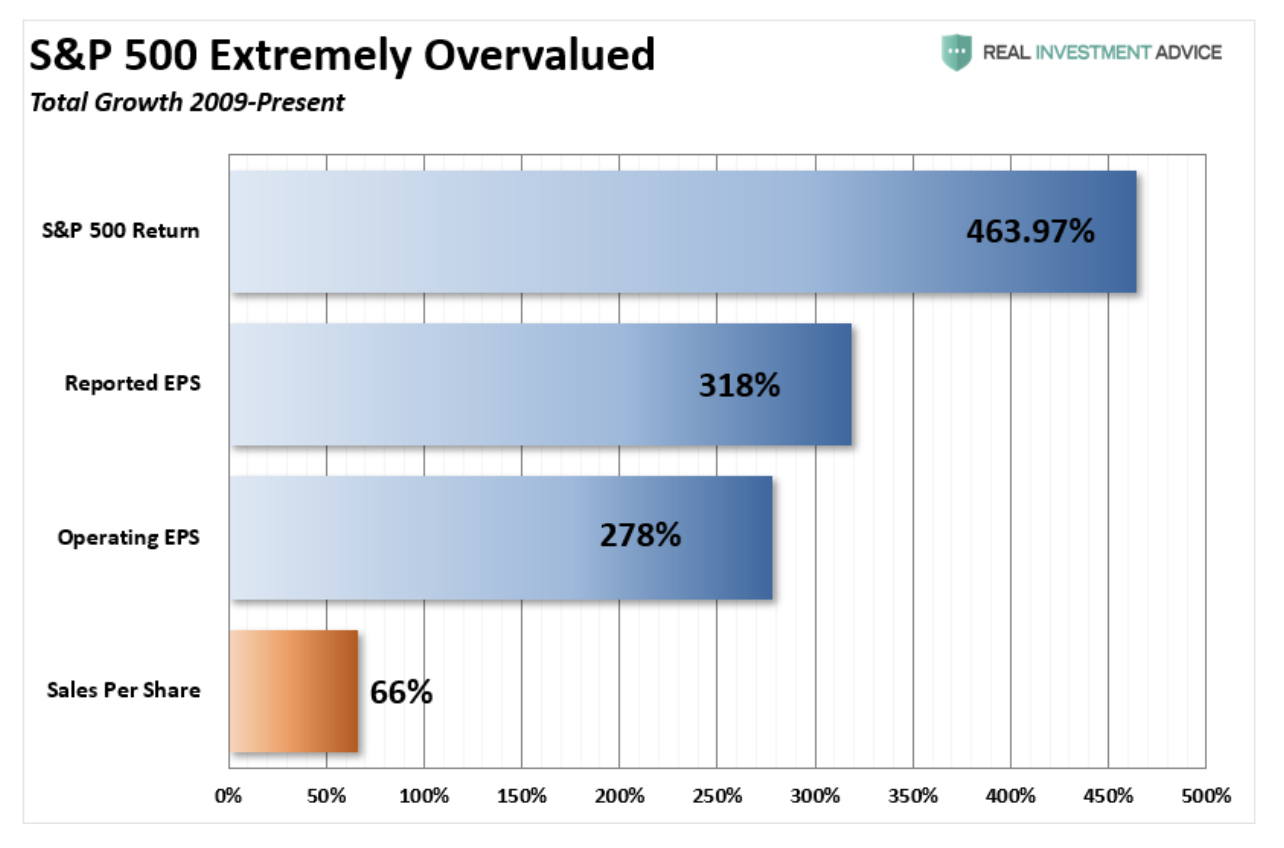

We see earnings growth for the market, but not the matching revenue growth. And perhaps that is part of the higher-level and longer-term framing of the U.S. stock market’s earnings and revenue story.Thought this was interesting.#Earnings are expected to hit $151 #reported this quarter

— Lance Roberts (@LanceRoberts) July 13, 2021

Q4-2020 = 94.13

Q1-2021 = 128.20

Q2-2021 = 151.17 est.

But here is revenue

Q4-2020 = 367.48

Q1-2021 = 364.05

Q2-2021 = 360.81

Anyone notice an issue relating to #Price/Sales

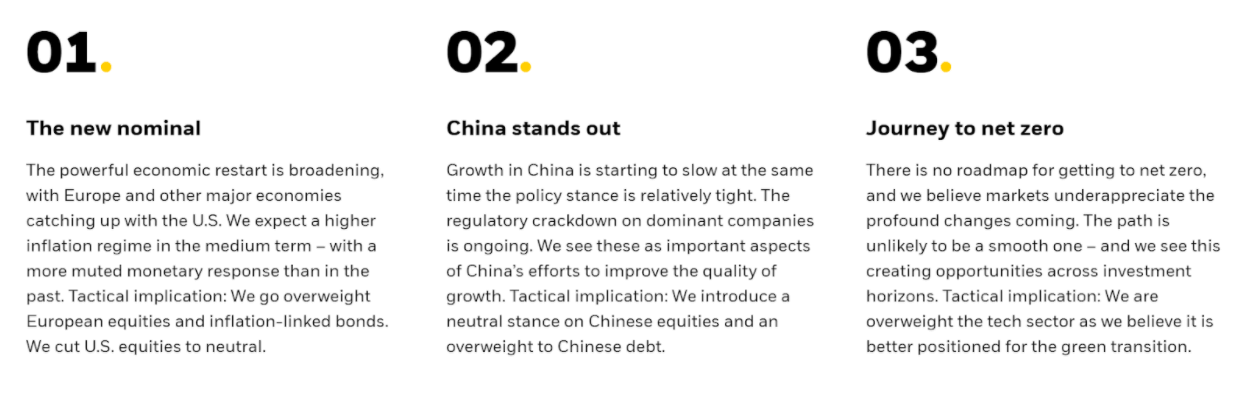

“The post-global financial crisis (GFC) playbook won’t work, in our view, as the historic monetary-fiscal collaboration to bridge the pandemic should lead to a higher inflation regime. This means we don’t expect another decade-long bull market in stocks and bonds.

“A restart is not a traditional business cycle recovery—you can only turn the lights back on once, so to speak. Fiscal stimulus and easy monetary policy have provided a bridge through the pandemic. We have estimated the U.S. has seen more than four times the stimulus compared with the GFC for less than one-quarter the shock.”

In that report, BlackRock is looking beyond the economic restart. The response to the GFC (Great Financial Crisis) perpetuated that low-growth disinflationary environment. That is all we investors of today have known. And the slowing-inflation environment has been very good for stocks and bonds—a.k.a., the traditional balanced portfolio.“We see the post-pandemic world as a very different one compared with the post-GFC landscape of deleveraging, sluggish growth, low inflation and constant policy support. That support helped herald a decade-long bull market in both risk assets and bonds.”

Playing off of the “new normal” terminology of the COVID world, BlackRock sees the post-restart economy and markets could potentially create the new nominal. There is a wonderful schematic in their presentation that lays out the potential pathways through the pandemic restart and on to the other side of the pandemic. What’s their take on portfolio positioning? It’s consistent with many of the themes put forth in this column. And it largely comes back to an all-weather portfolio that’s ready for inflation, just in case. They are also cautious of U.S. stocks. They like more equity exposure to Europe, Japan and emerging markets. As are many, I’m still a fan of Canadian stocks as well. On the bond front they do suggest some exposure to inflation-linked offerings.“We are taking advantage of the pullback in U.S. inflation breakevens to return to an overweight on Treasury Inflation-Protected Securities (TIPS). We find TIPS particularly attractive relative to inflation bets in the euro area where the outlook for inflation remains sluggish. We also like other inflation-linked exposures, such as commodities and real assets. We prefer TIPS to nominal U.S. Treasuries.”

BlackRock prefers more equity exposure over bonds, and suggests that stocks are not terribly overvalued given the low bond yields of the day. We might say that we take a core balanced portfolio approach that you’d find in the Best all-in-one ETFs for 2021 and then pay more attention to inflation. That’s what I’ve offered in this balanced portfolio.“We expect the tapering process to continue apace, with the bank winding down its QE by early next year. This will set the stage for rate hikes, likely within the next 12 months of the end of QE, with a good chance of sooner rather than later.”

Following that Bank of Canada announcement, the markets were well behaved; there was no taper tantrum. Dale Roberts is a proponent of low-fee investing who blogs at cutthecrapinvesting.com. Find him on Twitter @67Dodge.Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email