Making sense of the markets this week: July 21, 2024

Inflation in Canada cools, Netflix killed commercials only to bring them back, U.S. banks are cautiously profitable, and American healthcare recovers some losses.

Advertisement

Inflation in Canada cools, Netflix killed commercials only to bring them back, U.S. banks are cautiously profitable, and American healthcare recovers some losses.

Kyle Prevost, creator of 4 Steps to a Worry-Free Retirement, Canada’s DIY retirement planning course, shares financial headlines and offers context for Canadian investors.

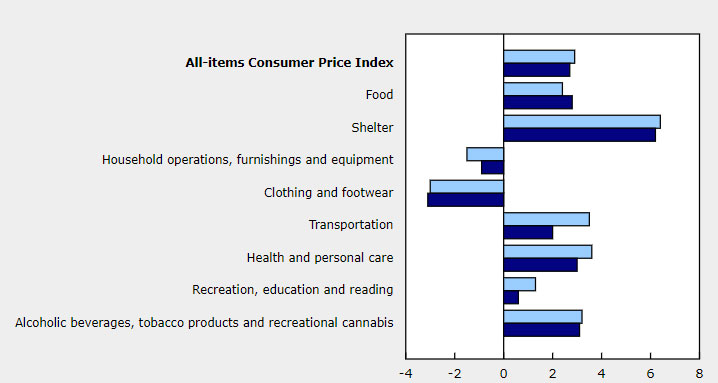

As we’re moving through summer’s dog days and heat records are being broken around the world, Canadian inflation is moving in the opposite direction. Statistics Canada released that the year-over-year Consumer Price Index (CPI) increase cooled to 2.7% in June. As inflation continues its downward trend, it generally indicates that the Bank of Canada’s monetary policy is working.

The main takeaways from the monthly CPI report are:

The business and individual sentiment surveys point to decreasing inflation expectations going forward, and are significant indicators that the Bank of Canada (BoC) has succeeded in curbing the scariest runaway inflation scenarios. The early 1980s saw the rise of denim and ultra-high interest rates. While ’80s fashion might be back, it’s pretty clear that the era’s monetary policy isn’t.

Decreased inflation is welcomed news by many Canadians, but it’s probably cold comfort to those with mortgages due for renewal this month. The country as a whole might be happier that demand-pull inflation is down, but that just really means: “People have way less money to spend on most things because their mortgage or rent payments just went through the roof.”

The lower inflation rates and decreased inflation sentiments should empower the BoC to continue to slowly but surely cut interest rates in the coming months. It would be shocking if the BoC didn’t lower interest rates by 0.25% when it makes its decision this week.

To check out the effects of inflation rates right now, use this table.

Read more: Canada’s inflation rate falls to 2.7% in June, driving hopes for July rate cut

Earnings day went largely as predicted for Netflix last Thursday, as earnings and revenues were quite close to the company’s guidance last quarter.

Currency figures in this section are reported in USD.

• Netflix (NFLX/NASDAQ): Earnings per share of $4.88 (versus $4.74 predicted). Revenue of $9.56 billion (versus $9.53 billion estimate).

Netflix sold more memberships than was predicted (277.65 million versus 274.40 million). The bulk of that subscriber growth was in its advertising-supported platform. The markets seemed to take the news in stride, as share prices were largely flat in after-market trading.

Netflix co-CEO Ted Sarandos highlighted the company’s focus on ads going forward, saying that the streamer would no longer partner with Microsoft. Instead, it’s investing in its own platform. He also mentioned that Netflix’s push into live sports would attract more ad dollars, specifically mentioning the NFL games on Christmas Day as important opportunities. He summed up the company’s push into live sports saying, “We’re in live [TV] because our members love it, and it drives a ton of engagement and a ton of excitement… and the good thing is advertisers like it for the exact same reason.”

With Netflix up over 43% this year, and at a price to earnings (P/E) ratio of over 44, one could make the argument the stock is priced appropriately, and that it will have to expertly execute future growth plans to have any chance of justifying that high price tag.

Get up to 3.00% interest on your savings without any fees.

Lock in your deposit and earn a guaranteed interest rate of 3.65%.

Earn 4.50% for 5 months on eligible deposits up to $500k. Offer ends January 31, 2026

MoneySense is an award-winning magazine, helping Canadians navigate money matters since 1999. Our editorial team of trained journalists works closely with leading personal finance experts in Canada. To help you find the best financial products, we compare the offerings from over 12 major institutions, including banks, credit unions and card issuers. Learn more about our advertising and trusted partners.

It was another modestly successful quarter for American banks, as earnings season kicked off this week.

Currency figures in this section are reported in U.S. dollars.

The top four key points from the last few months for banks financials are:

JPMorgan Chase’s CEO Jamie Dimon gave his usual cautious update: “The geopolitical situation remains complex and potentially the most dangerous since World War II—though its outcome and effect on the global economy remain unknown,” he said. “There has been some progress bringing inflation down, but there are still multiple inflationary forces in front of us: large fiscal deficits, infrastructure needs, restructuring of trade and remilitarization of the world.” However, the CFO, Jeremy Barnum, was more upbeat, stating that in looking at his firm’s credit data he saw consumers as quite healthy. “Yes, the economy is slowing, but it seems to be on trend for very much of a soft landing.”

Overall, the markets’ reactions to the banks’ earnings releases was relatively muted, with the share prices only moving up or down by a percentage point or two.

U.S. lender share prices are up about 16% so far this year. Several of these banks were popular Dogs of the Dow picks (highest dividend stocks on the exchange) for 2024. You can check out my article on Dogs of the TSX on milliondollarjourney.com to see if Canadian banks fit a similar value profile.

Canadians looking to invest in U.S. banks could so through TSX-listed ETFs, such as the Harvest US Bank Leaders Income ETF (HUBL), RBC U.S. Banks Yield Index ETF (RUBY) and BMO Equal Weight US Banks Index ETF (ZBK). Another way could be to get single-stock exposure to JP Morgan, Bank of America and Goldman Sachs in Canadian dollars through Canadian Depository Receipts (CDRs) listed on the Neo Exchange.

Both U.S. medical companies that reported earnings this week had good news to share.

Currency figures in this section are reported in U.S. dollars.

The positive earnings news was welcomed by the shareholders of the two medical giants. Both UnitedHealth and J&J have negative share price movement on the year, but saw a 3% to 4% bump on Wednesday.

Johnson and Johnson unveiled its plan to end the talcum powder litigation that has dogged the company over the last year. Current settlement offers are in the $11-billion range.

UnitedHealth continues to recover from a costly cyberattack that shaved off $0.74 per share in its first quarter.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email