Making sense of the markets this week: June 30, 2024

Inflation heats up, Canadians cut back gas and convenience spends, our economy continues to lose to the U.S., FedEx sprints ahead while Nike falls behind.

Advertisement

Inflation heats up, Canadians cut back gas and convenience spends, our economy continues to lose to the U.S., FedEx sprints ahead while Nike falls behind.

Kyle Prevost, creator of 4 Steps to a Worry-Free Retirement, Canada’s DIY retirement planning course, shares financial headlines and offers context for Canadian investors.

Canadians hoping for interest rate relief will likely have to wait a bit longer. The Consumer Price Index (CPI) reading for May came in at 2.9%, according to Statistics Canada.

The money markets predict a 45% chance that the Bank of Canada (BoC) will cut rates at its July 24 meeting. Lowering interest rates after a month of renewed inflation worries would carry a large credibility risk for the BoC, after it raised rates so quickly to restore faith that it would tame inflation over the long term.

Here are some notable takeaways from the CPI report:

We’re sure the BoC was hoping for inflation to be closer to 2.5%, which would allow it to justify cutting interest rates and point to a stronger downward trend for inflation. Continuing to balance long-term growth and full employment versus controlled inflation isn’t going to get easier anytime soon for BoC governor Tiff Macklem and his team.

For now, savers will continue to benefit from higher interest rates, like those of guaranteed investment certificates (GICs) and high-interest savings accounts (HISAs), while borrowers keep hoping for relief sooner rather than later. And, of course, to read about how to invest in a high-inflation world, see our article on the best low-risk investments at MillionDollarJourney.com.

Get up to 4.00% interest on your savings without any fees.

Lock in your deposit and earn a guaranteed interest rate of 3.55%.

Earn 3.7% for 7 months on eligible deposits up to $500k. Offer ends June 30, 2025.

MoneySense is an award-winning magazine, helping Canadians navigate money matters since 1999. Our editorial team of trained journalists works closely with leading personal finance experts in Canada. To help you find the best financial products, we compare the offerings from over 12 major institutions, including banks, credit unions and card issuers. Learn more about our advertising and trusted partners.

It was a tale of two extremes in U.S. earnings this week as FedEx shareholders became quite happy, while Nike investors were down in the dumps.

This is what came out of the earnings reports this week. Both Nike and FedEx report in U.S. dollars.

Nike finance chief Matthew Friend found himself in an odd position on his earnings call with analysts on Thursday. On one hand, Nike’s effort to reduce costs by shedding 1,500 jobs is paying off, and earnings per share came in substantially higher than experts predicted. On the other hand, declining sales in China and “increased macro uncertainty” were cited as reasons for a predicted sales drop of 10% in the next quarter. Investors chose to see the half-empty part of the glass, as shares plunged more than 12% in after-hours trading.

Friend attempted to put the downward forecast in perspective: “While our outlook for the near term has softened, we remain confident in Nike’s competitive position in China in the long term.” Nike highlighted running, women’s apparel and the Jordan brand as growth areas to watch going forward.

FedEx had a much better day, as shares were up more than 15% after it announced earnings on Tuesday. Future earnings projections were up on the news of increased cost-cutting efforts that will save the company about $4 billion over the next two years. FedEx announced possible increased profit margins as a result of consolidating its air and ground services.

Canada’s 13th-largest company, the gas and convenience store empire known as Alimentation Couche-Tard, announced its earnings on Tuesday.

Couche-Tard reports earnings in U.S. dollars.

The announcement brought a mix of good and not-so-good news. Revenues remained fairly strong, but earnings came in slightly lower than predicted. It’s the second quarter in a row that ATD missed on earnings.

The company claimed the earnings decline was chiefly due to the quarter being one week shorter than 2023’s reporting period, as well as increased depreciation attributed to investments and acquisitions.

| Canada (YOY) | U.S. (YOY) | Europe (YOY) | |

| Fuel (volume) | -3.5% | -1.6% | -1.7% |

| Same-store merchandise (sales) | -3.4% | -0.5% | -2% |

The more interesting data point: ATD also reported that earnings were down due to lowered profit margins and decreased consumer demand. It’s pretty clear from these numbers that Canadians are cutting back on spending when it comes to discretionary travel and convenience store purchases.

Investors anticipated a mixed earnings report, to some degree, as ATD’s stock has been quite volatile this year. It started 2024 with a share price of $78 (after a pretty incredible three-year run), then went up to $86 before plummeting to $74 in early April. The share price was hovering around $78 at press time. (Read: “Couche-Tard looks at acquisitions, and reports earnings drop.”)

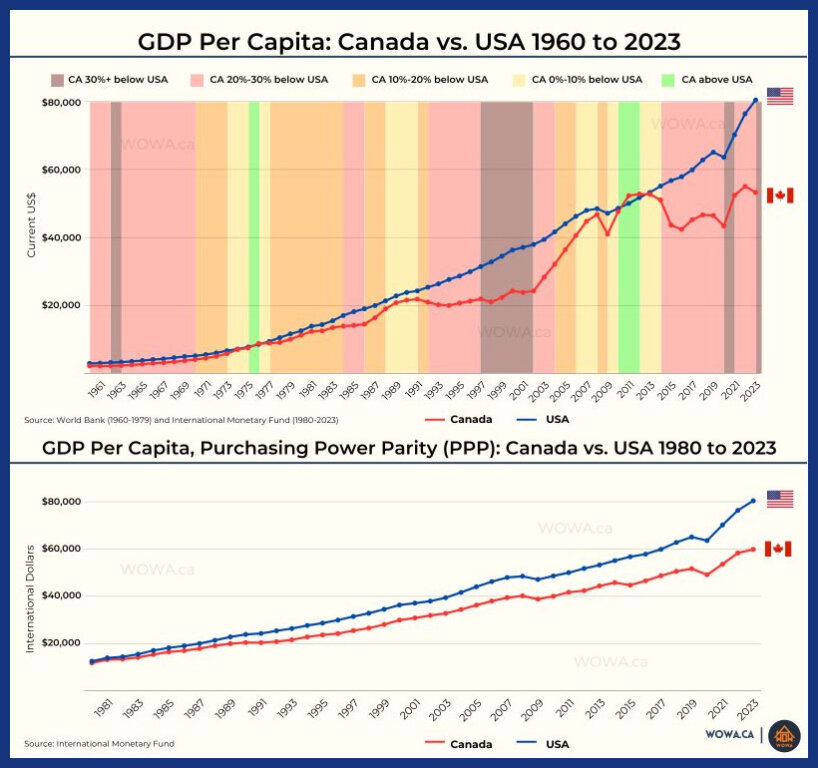

Metrics like GDP-per-capita can often seem nebulous and disconnected from our day-to-day lives; however, GDP increases are what allow us to increase our standard of living by creating more value than prior generations did.

Gross domestic product (GDP) is a statistic economists use to measure the total amount of goods and services produced in a country during a specific time period, usually a quarter or a year. This number is calculated in one of three ways.

Read the full definition in the MoneySense Glossary: What is GDP?

There was no predetermined destiny that said the United States’ GDP-per-capita would leave Canada’s in the dust. Indeed, as recently as 2011, Canada was a GDP-per-capita all-star.

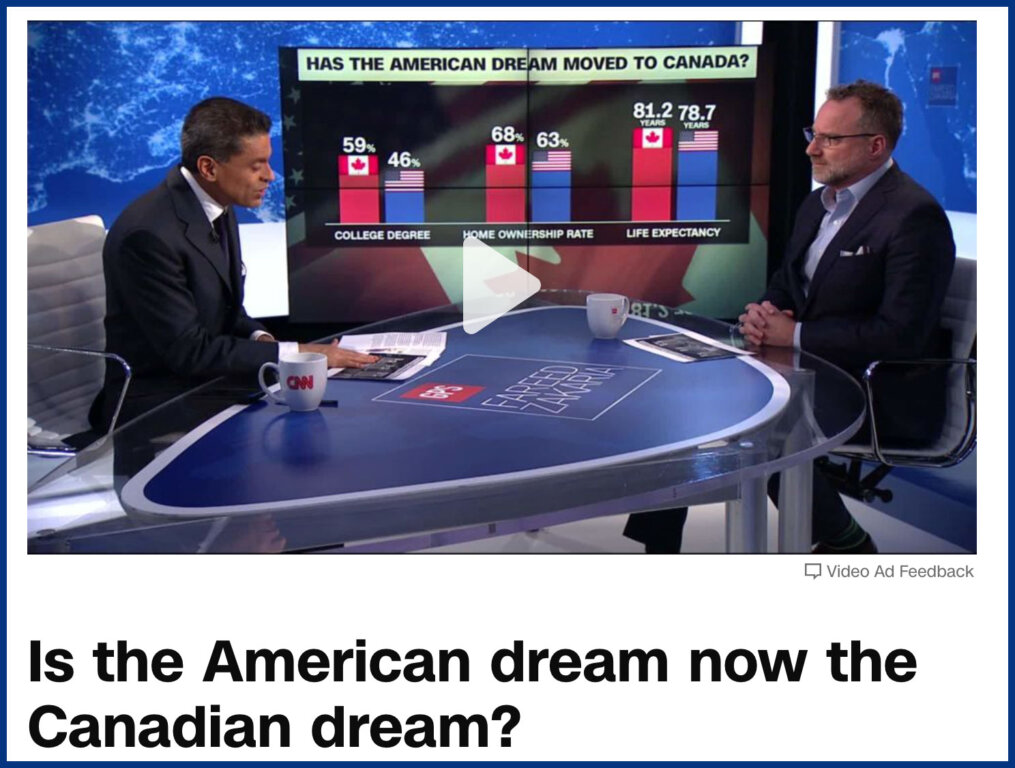

We used to see headlines and discussions like this one:

But those days of looking down at the American GDP are gone. And it doesn’t look like the trend is going to reverse itself anytime soon.

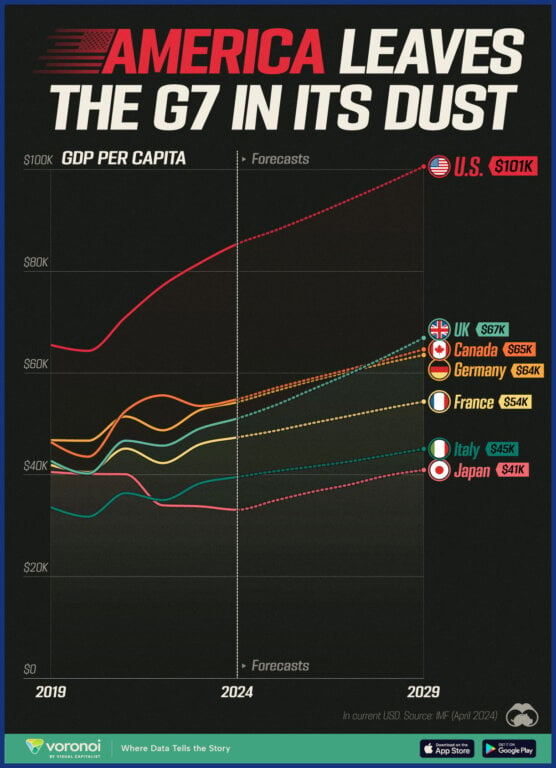

There’s no doubt the world is diverting from fossil fuels and toward mega-sized tech companies, and that has contributed to the disparity in GDP-per-capita between Canada and the U.S. The projections in the graphic above are not far-flung estimates from a patriotic American source, but rather from the International Monetary Fund (IMF). They are based on a future where the United States is doing everything it can to encourage investment in the U.S.A. for maximized returns.

The same commitment to bringing capital into a country cannot be found in Canada, or the other G7 countries, in fact. Canada’s been blessed with advantageous natural borders, the world’s biggest economy right next door, a bevy of natural resources, and probably the most successful type of government (parliamentary democracy) humanity has come up with. Yet, we continue to raise capital gains taxes, allow for provincial trade barriers, and regulate entire industries into the ground.

If we continue this economic atrophy, it could be very difficult for Canadian workers to produce goods and services that compete on the world stage. A consequence of not generating more value from each worker will likely be a shrinking economic pie. At that point, all that’s left to do is fight over smaller and smaller pieces.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email