Making sense of the markets this week: March 17, 2024

Oracle shares up 13%, Reddit’s unique IPO, Canadians are gloomier than most on world economic prospects, and Japan’s stock market is finally back on track.

Advertisement

Oracle shares up 13%, Reddit’s unique IPO, Canadians are gloomier than most on world economic prospects, and Japan’s stock market is finally back on track.

Kyle Prevost, creator of 4 Steps to a Worry-Free Retirement, Canada’s DIY retirement planning course, shares financial headlines and offers context for Canadian investors.

Whether we’re talking software, streaming, artificial intelligence (AI), computer chips or, now, servers, the U.S. tech sector is booming at the moment. After reporting earnings on Monday this week, shares of server extraordinaire Oracle climbed 13%.

All numbers in this section are in U.S. dollars.

Cloud services are Oracle’s bread and butter. And as CEO Safra Catz told reporters on the earnings call, “We signed several large deals this quarter and we have many more in the pipeline.” Oracle’s co-founder and executive chairman Larry Ellison said, “We’re building 20 data centres from Microsoft and Azure. They just ordered three more data centres this week.”

Given that earnings and revenues were consistent with expectations, the massive share price rise for Oracle appears to be driven primarily by general exuberance around the potential for U.S. technology stocks to continue growing at unprecedented rates.

In non-tech earnings news, shares of Dollar Tree sank more than 15% to their lowest level this year in early trading Wednesday. The company revealed plans to close nearly 1,000 stores in a bid to increase profitability.

Discount store rival Dollar General had a better earnings day on Thursday, as shares were up 6% on an earnings beat.

You can read about Canadian dollar store king Dollarama in our look at Canadian retail stocks on MillionDollarJourney.ca.

After 18 years, Reddit plans to offer its first opportunity for the public and key users to buy its shares on March 21, 2024. (Figures in this section are in U.S. dollars.)

The old-school social media stalwart is looking to raise about $750 million by selling 22 million shares at $34 per share.

One unique aspect of Reddit initial public offering (IPO) is that the social media company is looking to recognize and reward its key users by reserving 1.76 million shares for moderators (a.k.a. Redditors) to purchase the stocks. These power users will be able to purchase their shares immediately, then sell them on the open market without waiting for expiry of the typical six-month lock-up period that accompanies most IPO share purchases.

Reddit will trade on the New York Stock Exchange under the ticker RDDT. Some notable shareholders in the company include Tencent and AI guru Sam Altman, who was a member of Reddit’s board as recently as 2022.

A few interesting facts about Reddit and its IPO:

It will be interesting to see how the open market values yet another tech company with big potential and nowhere-to-be-seen profits. Additionally, market watchers will be looking to see how the Redditors handle their opportunity to pre-purchase shares, and how that might contribute to price volatility given their unique ability to sell shares immediately.

If you’re looking to understand a bit more about the mentality behind IPOs for non-profitable companies, the following NSFW clip about revenue and profits from HBO’s Silicon Valley is both amusing and instructive. Some readers may find the language offensive.

Get up to 4.00% interest on your savings without any fees.

Lock in your deposit and earn a guaranteed interest rate of 3.55%.

Earn 3.7% for 7 months on eligible deposits up to $500k. Offer ends June 30, 2025.

MoneySense is an award-winning magazine, helping Canadians navigate money matters since 1999. Our editorial team of trained journalists works closely with leading personal finance experts in Canada. To help you find the best financial products, we compare the offerings from over 12 major institutions, including banks, credit unions and card issuers. Learn more about our advertising and trusted partners.

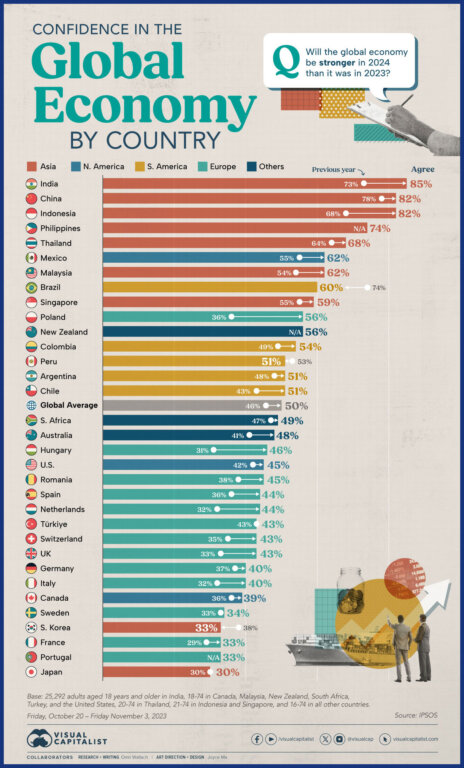

Visual Capitalist published an interesting economic confidence graphic using data collected by Ipsos.

We found the range in responses to be fascinating and somewhat counterintuitive. Here are some initial thoughts:

We’re not psychologists, but there has to be some sort of non-mathematical answer to why people are feeling the way they are. Is it some sort of media bias in certain countries versus others? Is there a cultural lean towards optimism in certain countries?

There appears to be a strong inverse correlation between levels of post-secondary education of its residents and their confidence in the world’s economy. Does that make people in the countries at the top of this list naive? Or, is it a matter of more educated people actually having a factually-incorrect negative bias?

While there are always risks to the global economy, and arguments can be made about our impending doom, we think, on balance, there are more reasons to be hopeful than not these days.

Maybe we’re not as “Canadian” as we thought.

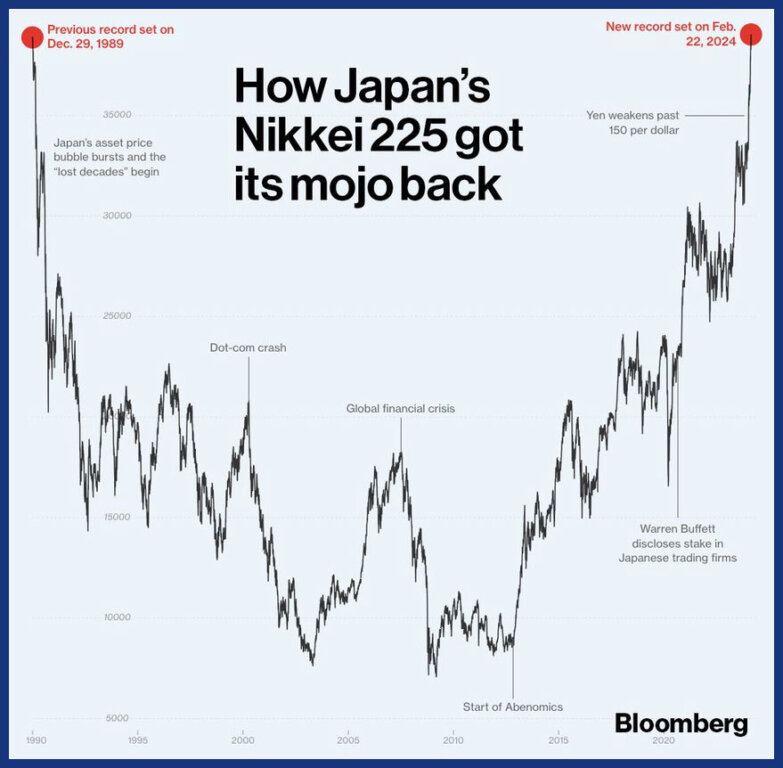

For a few decades now, stock-market skeptics could always be counted on to say, “Now show Japan” whenever an optimistic long-term forecast is made. They may soon have to find a new hymnbook from which to sing.

The Nikkei 225 (the 225 biggest stocks in Japan, and the main index used to indicate the overall health of the Japanese stock market) has consistently hit new highs the last few weeks. While that’s not all that unique right now, despite the pessimism expressed above, many countries have stock markets currently hitting all-time highs. What makes Japan different is how long Nikkei 225 investors have been waiting for these new highs.

American investors had to wait 746 days (beginning January 2022) for the S&P 500 to reach its new high.

Japanese investors had to wait more than 16 times as long—34 years!

The Nikkei 225 recently passed 38,000 for the first time since December 29, 1989.

Business textbooks are always teaching the Japanese business concepts of Kaizen, Kanban, Andon and just-in-time production. But despite this, the actual market valuations of Japanese businesses have been falling behind for a long time now (basically my entire life).

What some investors fail to understand about this historical anomaly is just how massively overvalued the vast majority of companies were in Japan in 1989. It’s as if Japan’s entire stock market had Tesla- or Nvidia-level expectations of world domination.

Here’s a few takeaways from Ben Carlson of A Wealth of Common Sense:

So, in regard to the constant naysayers who want to compare the “lost decades” of the Japanese stock market to current market conditions, we can only say there is no data to support this level of pessimism. In other words, there are market bubbles, and then there’s the Japanese bubble.

As usual, celebrated investor and CEO of Berkshire Hathaway, Warren Buffett was a bit ahead of the curve on this one. He’s been buying up Japanese assets for several years. Buffett was quoted by CNBC back in 2023 as saying, “We couldn’t feel better about the investment [in Japan].”

It’s also worth noting that even Japanese stocks win “in the long run.”

If you put $1 a day into Japanese stocks starting in 1980 (~$10,500 in total), you'd have over $17,000 today (thanks to recent all-time highs).

— Nick Maggiulli (@dollarsanddata) February 26, 2024

This is true despite Japan experiencing one of the worst equity market returns in history during this time period. pic.twitter.com/2t8SG9xJfV

As Nick Maggiulli, author of Just Keep Buying (Harriman House, 2022), says in the above tweet, if you had started investing in the Nikkei 225 in 1980 (in the run-up to the Japanese bubble), you’d still have a real annual return of 3.5% today (inclusive of dividends).

Carlson also points out that if you invested in a Japanese stock index back in the early 1970s, your returns would still be about 9% a year, despite the biggest bubble of all time bursting in the middle. It’s just that all future returns were pulled forward due to manic speculation—and investors have been waiting for companies to “grow into their valuations” ever since. After waiting a long time for the earnings growth spurt to kick in, it appears the valuation shoes finally fit.

Of course, no such Japanese index fund existed at the time. Today, Canadian investors can efficiently get Japanese exposure through exchange-traded funds (ETFs), such as the iShares Japan Fundamental Index ETF (CJP) or the BMO Japan Index ETF (ZJPN).

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email

Canadian’s probably see the economy as bad because it hurts in places that matter to them: housing and food. Food is much more expensive, whether through inflation or increased profit margins, or both, and buying a home to start a family is unachievable (unless you live rural, where there are very few jobs).