Making sense of the markets this week: October 27, 2024

The Bank of Canada’s jumbo rate cut, Canadian railway earnings stay on track, Rogers disappoints, and Tesla surges on rising car sales.

Advertisement

The Bank of Canada’s jumbo rate cut, Canadian railway earnings stay on track, Rogers disappoints, and Tesla surges on rising car sales.

Kyle Prevost, creator of 4 Steps to a Worry-Free Retirement, Canada’s DIY retirement planning course, shares financial headlines and offers context for Canadian investors.

The Bank of Canada (BoC) wasn’t in the mood for taking baby steps this week, as it cut its key interest rate from 4.25% to 3.75%. The 0.50% rate cut was larger than what we’ve seen over the last three months. And, it’s the first time for a 50 basis point cut since 2009, outside of what was happening during COVID-19. (A basis point, a.k.a. BPS, is 1/100 of 1%.)

The options markets didn’t move much based on the news, and the swap-trades market is still predicting the key lending rate will be close to 2.5% by the end of 2025.

“We need to stick the landing,” said Governor Tiff Macklem in the Bank of Canada’s opening statement. “With inflation back to 2%, we want to see growth strengthen. Today’s interest rate decision should contribute to a pickup in demand.”

Macklem went on to add, “Job layoffs have remained modest but business hiring has been weak, which has particularly affected young people and newcomers to Canada. Simply put, the number of workers has increased faster than the number of jobs.”

The relative strength of the U.S. economy could put a higher floor underneath interest rate movements than economists predicted a few months go. That U.S. economic strength is in turn likely to put pressure on the BoC not to fall too far out of lockstep with the trend-setting U.S. Federal Reserve’s interest rate (now at 4.75% to 5%). The Loonie remained largely unchanged versus the Greenback as a result of the widely-anticipated rate cut.

Until inflation rates kick back up above 3%, the BoC is likely to keep cutting rates in a bid to get economic growth back on track and the employment rate moving in the right direction.

Get up to 4.00% interest on your savings without any fees.

Lock in your deposit and earn a guaranteed interest rate of 3.55%.

Earn 3.7% for 7 months on eligible deposits up to $500k. Offer ends June 30, 2025.

MoneySense is an award-winning magazine, helping Canadians navigate money matters since 1999. Our editorial team of trained journalists works closely with leading personal finance experts in Canada. To help you find the best financial products, we compare the offerings from over 12 major institutions, including banks, credit unions and card issuers. Learn more about our advertising and trusted partners.

While we’ve seen better earnings calls for Canadian National Railway (CNR) and Canadian Pacific Kansas City (CPKC) before, the news could also have been much worse.

Here’s what came out of earnings calls this week.

With profits and revenues largely tracking their predicted outcomes, it isn’t much of a surprise that share prices were relatively stable this week. CNR was up 2% in after-hours trading on Tuesday, and CP was down 1% after announcing earnings on Wednesday.

With the railway employee strikes earlier this year leading to decreased revenues, shareholders were likely expecting some degree of regression. CPKC CEO Keith Creel highlighted “a very challenging operational quarter.” In addition to the strike, CPKC lost $60 million off its bottom line due to a hazardous-material spill in North Dakota in July this year.

Despite these setbacks, CPKC posted an income gain of 7% year over year. The four categories that made the most impact were grain, energy, plastics and chemicals, and they grew revenues by 11%. CPKC says the shipment of wheat to Mexico from the Canadian and American Prairies over the past 12 months was exactly the type of “synergy win” that it was hoping for when the former Canadian Pacific acquired Kansas City Southern back in 2021. This railway remains the only one to span Canada, the United States and Mexico.

CNR CEO Tracy Robinson commented on the railway’s operational challenges. “Our scheduled operating plan demonstrated its resilience in the third quarter, allowing us to adapt our operations to challenges posed by wildfires and prolonged labor issues,” she said. “Our operations recovered quickly and the railroad is running well. As we close 2024, we will continue to focus on recovering volumes, growth, and ensuring our resources are aligned to demand.”

CNR’s revenues were up 3% year over year; however, increased expenses meant the company’s operating ratio rose 1.1% to 63.1% (indicating that expenses are growing as a share of revenue). The railway announced it was raising its quarterly dividend from $0.79 to $0.845. This raise of nearly 7% is right in line with CNR’s mission to conservatively raise its dividend payouts each year.

For more information on these railroads, check out my article on Canadian railway stocks at MillionDollarJourney.ca.

Thursday’s revenue miss left some Rogers shareholders shaking their heads.

Here’s what the large mobile company reported this week:

While solid earnings numbers did take away some of the sting, Rogers’ share price was down 3% on Thursday. Lower-than-expected numbers for new wireless customers were at the root of low revenue growth. The oligopolistic Canadian wireless market remains uncharacteristically competitive as Rogers, Telus and Bell all continue to fight for market share. That competition is hurting profit margins for all three telecommunications giants at the moment. (Unlike in past years, when the three telcos all enjoyed charging some of the highest wireless plan fees in the world.)

One highlight for Rogers was its sports revenue vertical, which was up 11% from last quarter. Rogers has really doubled down on its sports media strategy over the last few years and now owns a controlling share of the:

Despite owning all those household-name sports assets, it’s worth noting that Rogers’ wireless and cable divisions were responsible for close to 90% of revenues, with sports and media making up the rest.

Rogers’ American telco cousins down south had slightly better wireless growth to report as their financial quarters also wrapped up this week.

All figures below are in U.S. currency.

Both AT&T and Verizon gained slightly more wireless subscribers than market-watchers predicted for the last quarter. Lower phone upgrade volumes and a faster-than-expected decline in home phone fixed-line subscribers were cited as areas of concern. New customers for fibre internet were added at a slightly lower rate than analysts had predicted.

The big picture: it was a pair of fairly uneventful market calls on Wednesday that saw Verizon shares increase 3.2% and AT&T shares rise 1.8%.

The earnings week was bookended by earnings reports from major North American car manufacturers:

All figures below are in USD.

Tesla’s stock surged 22% on Thursday, after it forecast rising growth in sales of Elon Musk’s core business of electric vehicles (EVs). It dipped 1.7% before markets opened Friday. On Wednesday, Elon Musk forecasted sales growth of 20% to 30% next year and said margins should be boosted by efforts to cut production costs. He also promised a more affordable vehicle.

It’s become impossible to separate Musk “the businessman” from “the political booster.” Musk recently became a noted supporter of former (and possibly future) President Donald J. Trump. Many Tesla fans and shareholders have expressed displeasure with Musk’s very public political adventures. It’s interesting to note that Tesla benefited from a $739 million cheque from the U.S. federal government in the form of environmental regulatory credits. Something tells us that sending taxpayer dollars to EV companies probably isn’t a big priority for the Republican Party, considering 71% of Republicans would never consider purchasing an electric vehicle (EV).

It wasn’t just the EV sales that had a great quarter. GM posted a massive earnings beat on the back of increased North American truck sales. GM CFO Paul Jacobson was upbeat in the earnings call, saying “The consumer has held up remarkably well for us. Nothing we see has changed from where we’ve been for the last several quarters.” Notably, the average transaction price per vehicle has stayed above $49,000. GM’s stock price was up nearly 10% on the day, and earnings were up nearly 13% year over year.

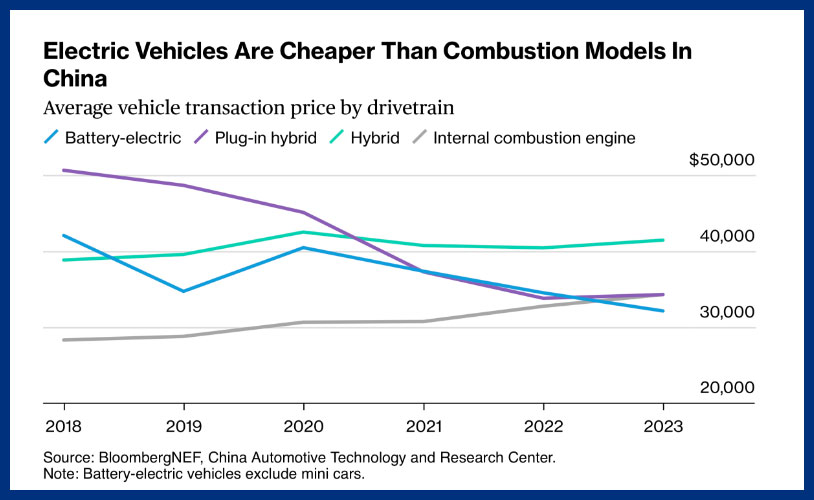

For what it’s worth, we still think Chinese EV companies will be tough to beat long term. While China’s government does subsidize the EV industry as a whole, it has encouraged intense competition between dozens of companies in order to winnow out the EV pretenders from the contenders. As a result of this competition, the cost of producing lithium battery cells is down 51% over the past year. What that means is that for the first time ever, it’s actually cheaper to buy an EV in China than a vehicle with an internal combustion engine (ICE).

The chart above references the purchase price. The long-term savings from not having to burn gasoline or diesel are an even larger financial consideration.

These companies are so vertically integrated that the largest of them—Warren Buffett-owned BYD Auto—actually has its own delivery ships.

In order to protect our domestic car manufacturers, Canada and the United States recently slapped EV imports from China with a 100% tariff rate. Europe has also raised its tariff rates, but with plans to begin manufacturing in Hungary, BYD looks like a very good bet to grow European sales. In non-tariff markets like Australia, chinese-manufactured EVs now account for more than 80% of sales.

If BYD and other Chinese EV makers can grow internationally at their current pace (in addition to having a massive advantage within their growing home market) it will be difficult for other vehicle manufacturers to compete with that economy of scale combined with vertical integration. Relatively high-quality vehicles such as BYD’s Dolphin model can be purchased in China for as little as 99,800 Yuan (CAD$19,400). That vehicle will get you up to a range of 500 kilometres in city driving conditions.

Clearly, Tesla, GM, and the rest of the world’s car companies better up their games in a hurry. Or maybe they can just keep selling very expensive ICE pick up trucks to the North American market forever. It certainly worked last quarter.

No, of course not. That’s why, finally, I wanted to make sure that everyone is aware that the 2024 Canadian Financial Summit is happening now! Hurry, and don’t miss out on this 100% free online summit. Reserve your spot today (first come, first serve). MoneySense’s own Lisa Hannam, Jonathan Chevreau, Jaclyn Law and Michael McCullough are featured, plus many other Canadian experts.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email