Best mutual funds 2016

Power your RRSP with the best mutual funds, based on performance, price and safety. Our picks regularly outperform

Advertisement

Power your RRSP with the best mutual funds, based on performance, price and safety. Our picks regularly outperform

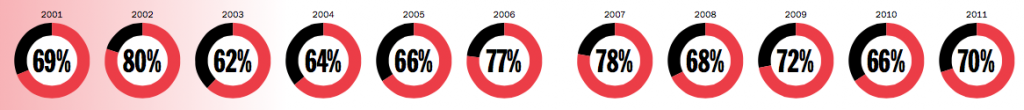

It’s been a tumultuous year for many investors. As the bear market for commodities continues to take its toll, equity markets that are heavily dependent on commodities, including Canada’s, have continued to suffer. However, long-term investors who chose to invest in our Honour Roll funds, at least for part of their portfolio, have generally fared better than the rest. More than 70% of last year’s Honour Roll has delivered superior returns versus their peers.

SUBSCRIBERS ONLY: View the Best Mutual Funds 2016: Honour Roll for FREE online »

That is not to say Honour Roll funds are only good for bad years. Over the past 15 years MoneySense has been rating Canada’s best mutual funds, roughly a similar percentage of Honour Roll funds have out-performed their peers. If you stick to our methodology, you could have a very good chance of staying ahead over the life of your investments. That’s a claim no other mutual fund ranking in Canada can make.

SUBSCRIBERS ONLY: View the Best Mutual Funds 2016: Honour Roll for FREE online »

Because I don’t like losses, my number one investing rule is “keep your principal safe.” It’s why my selection methodology excludes funds with very high volatility as well as funds that perform poorly in down markets. I also exclude funds with another major impediment to long-term performance: high investment cost. Otherwise, our Honour Roll funds meet strict criteria for consistent above-average performance and value added from active portfolio management, which I measure using risk-adjusted return. This year, I had to raise the minimum consistency requirement to 60% (versus above 50% for other categories) for Canadian equity funds in order to reduce the Honour Roll funds to a manageable number. As a result, the selected 17 funds in that category all have unusually high consistency of returns. In the tables that follow, you’ll find the best-performing funds in their respective categories. We’ve also include ratings for risk and cost, so you can pick the funds that are the best fit for your portfolio.

In a nutshell? Market divergence. While commodity-dependent economies, such as Canada, Australia and some emerging countries, will remain in the penalty box throughout 2016, several high-income countries, like the U.S. and most of Europe will fare better, but only in relative terms.

Against this backdrop, you have one choice: Stay the course. The science of market prediction is as reliable as astrology. Rather than fear what is to come, remember that market fluctuations are a fact of life.

This all underscores the importance of remaining diversified. Yes, you can continue to expect weakness in Canadian equities and the Canadian dollar, but every cycle invariably works itself out. Weak prices will push high-cost producers out of business and shrinking supplies will bring balance to commodity prices. It could happen later this year, or the next, but it will happen.

For those reasons, it is important to avoid big bets. This year’s model portfolios (see “Best bets for your RRSPs“), which I prepare each year, help you achieve optimal diversification among asset classes, sectors and geographies. I continue to exclude bond funds from the Honour Rolls. Canadian bond yields have dropped to extremely low levels such that most managed funds would post flat or negative results after subtracting management fees. Therefore, rather than investing in a managed bond fund, you are better off filling the bond component of your portfolio with a cheap index bond fund or ETF.

SUBSCRIBERS ONLY: View the Best Mutual Funds 2016: Honour Roll for FREE online »

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email