How do RESPs work, and what’s the best way to fund them?

An RESP is one of the best ways to save for a child’s education. Compare three ways to fund an RESP and maximize government grants.

Advertisement

An RESP is one of the best ways to save for a child’s education. Compare three ways to fund an RESP and maximize government grants.

Does your child have a registered education savings plan (RESP)? This tool is one of the most effective ways for families to save for higher education. Your investments grow tax-free, plus—to reward you for saving—the government contributes grants of up to $7,200 over the life of the plan.

What most parents want above all else is for their children to be happy, healthy and successful, and investing in a good education can help them get far in life. But post-secondary education doesn’t come cheap—in 2022–23, the average tuition for one year in an undergraduate program in Canada was $6,834. Over four years, that adds up to over $27,000—not including other costs like residence and textbooks.

An RESP is a tool for parents, grandparents and others to save for a child’s college or university expenses. In this article, we’ll explore questions like: What is an RESP? How does an RESP work? And, most importantly, how can families make the most of an RESP? We’ll also look at three strategies to reach your savings goal.

RESPs work similarly to other registered accounts, including registered retirement savings plans (RRSPs) and tax-free savings accounts (TFSAs), in that they’re tax-sheltered. But the key difference is the goal for the account—to pay for post-secondary school. Here are eight ways an RESP can work for the young student (or student-to-be) in your life.

Is it best to maximize the CESG grant every year by depositing $2,500 annually? Should you deposit the maximum contribution of $50,000 as soon as possible? Or perhaps some hybrid of the two?

To help answer those questions, I reached out to Tony Liut, a Personal Financial Planner (PFP) and an investment advisor at RBC Wealth Management.

“I tell my clients that the most important thing is to take advantage of RESPs because they are a great way to get more money tax-sheltered while receiving a 20% government benefit,” says Liut. “But for those who want to optimize the account, there are a few options.”

RESPs can stay open for as long as 35 years; for our examples, we’ll assume an RESP is opened in a child’s first year and contributions end in the 18th year. The following are simplified examples for illustration and comparison only.

The most obvious way to maximize the RESP account balance is to take full advantage of the CESG—that’s the 20% grant the government adds, up to $500 per year on a $2,500 contribution. “This ‘free money’ is basically a guaranteed 20% rate of return,” says Liut. “That’s tough to beat.”

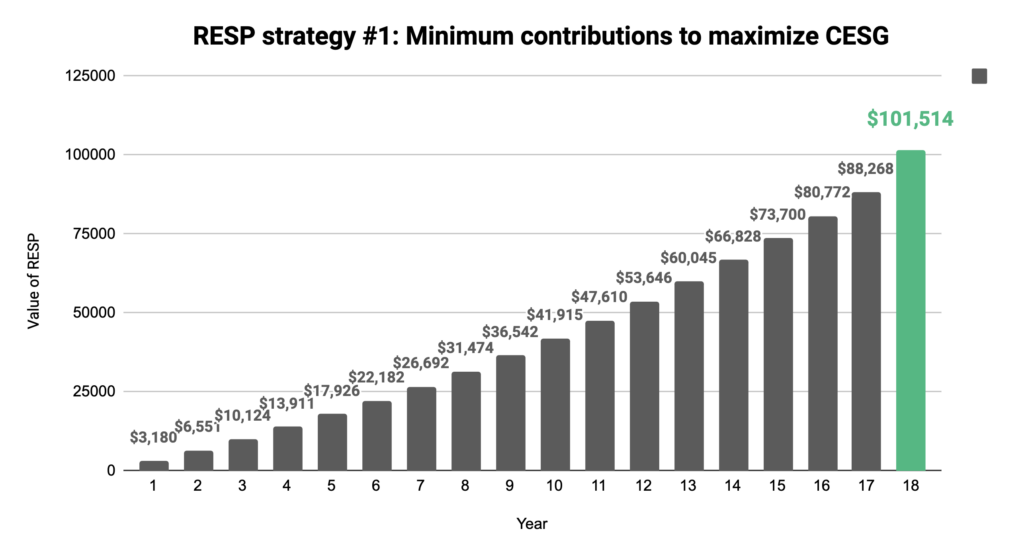

Regular RESP contributions have the additional benefit of dollar-cost averaging: investing equal amounts of money at regular intervals (say, once a month) instead of larger lump sums less often (say, once a year). This decreases market risk and smooths returns over time. Let’s run some numbers using a simplified example. If you were to contribute $2,500 annually, you would reach the $7,200 CESG limit in the RESP’s 15th year. The $50,000 contribution limit could be reached by making a bigger contribution—$7,500—in year 18. Assuming a 6% average rate of return, the final RESP account balance would be $101,514: $50,000 from contributions, $7,200 from the CESG and $44,314 from investment income.

Liut’s take on this approach: “This is a great option for many people who don’t have extra money to contribute upfront but want to maximize the CESG. For those who have extra non-registered funds, however, I am often asked if a lump-sum contribution is the best approach.”

Next, we’ll explore using a lump sum to front-load an RESP.

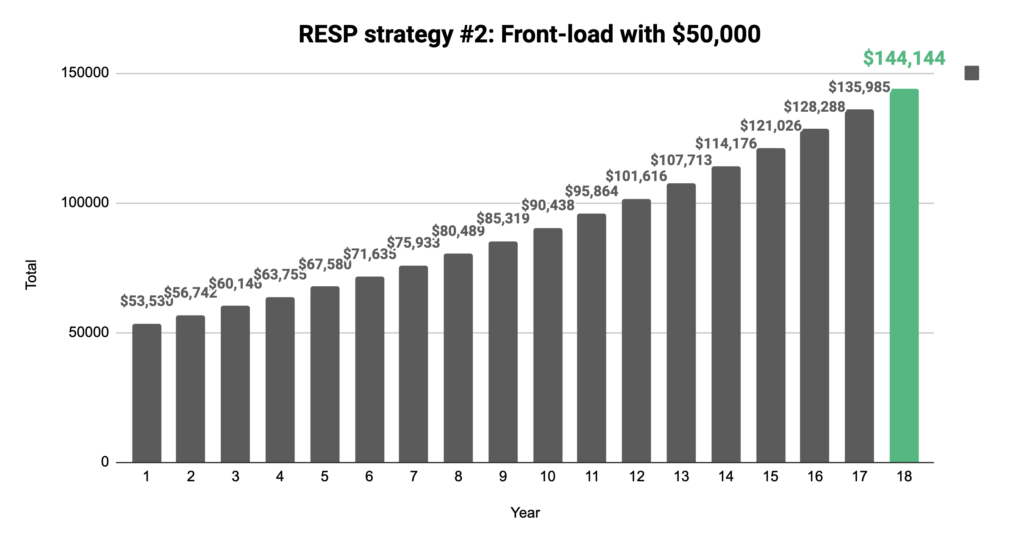

Few families will have the ability to contribute the maximum $50,000 in year one, and this approach also carries the risk of markets slumping soon after investments are purchased. However, it’s worth considering this option to see the potential benefits of getting investments tax-sheltered early.

Contributing the maximum $50,000 in year one would only result in $500 of CESG. On the other hand, all that money can grow tax-free for the full 18 years. For illustration purposes, assuming a 6% average rate of return as in our first example, front-loading with $50,000 would result in a final balance of $144,144: $50,000 from contributions, $500 from CESG and $93,644 from investment income.

So, we have our answer, right? Not so fast.

Even though front-loading appears to be a better strategy than option 1 because of the higher overall return, here’s why it’s not: It ignores the fact that if the $50,000 had not been used to fund the RESP, it could have been invested elsewhere. Those investment returns, particularly if they are received within a tax-sheltered account like a TFSA or RRSP, would negate the benefit of front-loading. To be beneficial, any lump-sum contribution must come from funds available after RRSPs and TFSAs have been maxed out.

“The benefit of lump-sum RESP contributions is really to move funds into a tax-sheltered account as early as possible,” says Liut. “So, it only works if the other registered accounts are already being maximized.”

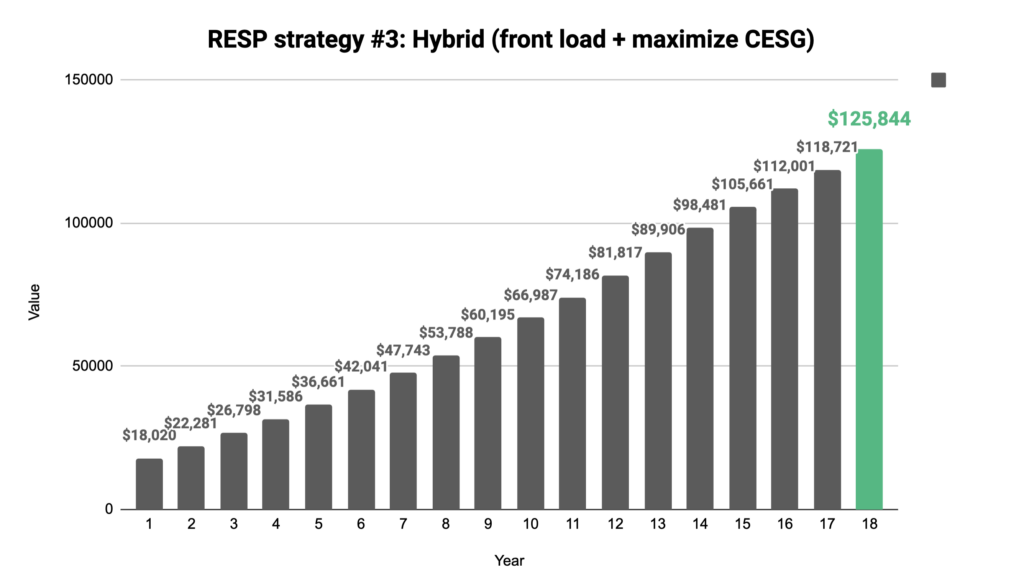

Is there a way to get the best of both worlds: maximize the CESG and benefit from a lump sum invested for longer? “Absolutely,” says Liut. “If I have a family that has non-registered money saved up for their child at birth, I will suggest a lump sum of $16,500 in year one, then $2,500 each year for 13 years and $1,000 in year 15, for a total of $50,000.” Again, let’s run the numbers. Using Liut’s example, and once again assuming a 6% average rate of return, the final RESP balance would be $125,844: $50,000 from contributions, $7,200 from CESG and $68,644 from investment income.

If you’re short of funds and want to make an RESP contribution, you might wonder if it makes sense to borrow money to invest (also known as “using leverage”).

“Prior to making any financial decision involving leverage, there is always a lot of discovery and planning involved,” says Liut. “Usually, the short answer is: No, it’s not a good idea to borrow to invest. Remember, the interest on loans to invest in registered accounts like RESPs is not tax-deductible.

That said, if you have low debt prior to having children or you have variable pay that has an inconsistent schedule, borrowing at a low rate could make sense for a short duration given the 20% CESG.”

For most families, the optimal strategy for funding an RESP is likely a hybrid approach: maximize tax-sheltered growth by contributing a moderate lump sum early, then contribute $2,500 annually to maximize the CESG.

But even if you can’t contribute a significant lump sum, or if you never reach the RESP limit of $50,000 or get the full $7,200 from the CESG, contribute what you can—your child will still benefit from the tax-sheltered investment growth and government grants, and any unused grant room can be carried forward until the end of the year in which the beneficiary turns 17.

As an added bonus, in 2022 the Canada Deposit Insurance Corporation (CDIC) extended its coverage to insure up to $100,000 per RESP beneficiary. CDIC protects eligible deposits against the failure of its member financial institutions. For RESPs, the coverage applies to term deposits and GICs but not stocks, bonds, exchange-traded funds (ETFs) or mutual funds.

Video: Are GICs a good investment? Depends on your life stageShare this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email

My grandson is on an apprenticeship program in welding and is to start his first term of in class. We have been told that since he is going to a union trade school, we cannot withdraw money from the RESP account.

Was the reason to set up an RESP to help our young people in school and why are we being turned down, not all students are college or university bound, and since there is a real outcry for trades people

Thank you

I think you need to verify this yourself. I would not trust the institution you deal with to know the ins and outs of resp. Government website is informative. I can’t count the number of times folks behind those counters have given bum steer!

The rules for resp have been modified to include other types of education options.