Stocks to help you achieve your financial goals

Investors love home runs, but getting consistent hits will do more for your portfolio

Advertisement

Investors love home runs, but getting consistent hits will do more for your portfolio

What are we looking for:

What are we looking for:A concentrated low volatility portfolio for Canadian Markets.

For most retail investors and stock jockeys, the idea of finding “the next best stock” is often front of mind. However, disciplined and seasoned investors know that the portfolio that will ultimately help you reach your financial goals is not achieved by hitting one or two home runs, but rather getting onto first base consistently over time. With this in mind, I used Morningstar CPMS to create a low volatility portfolio by ranking stocks within the largest 200 companies in Canada by market float (excluding unit trusts) based on 3 factors:

The portfolio was designed to be very concentrated, holding only 10 positions, never owning more than three stocks per economic sector to ensure some diversification across the economy. (See the portfolio below)

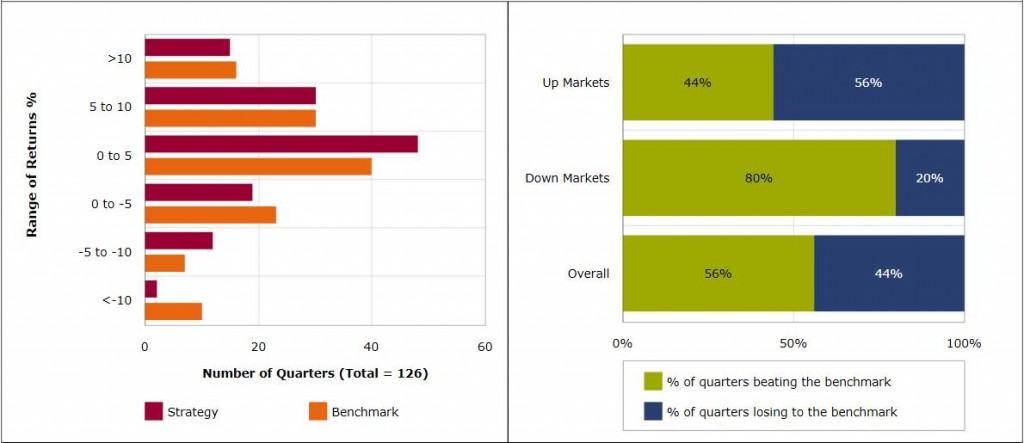

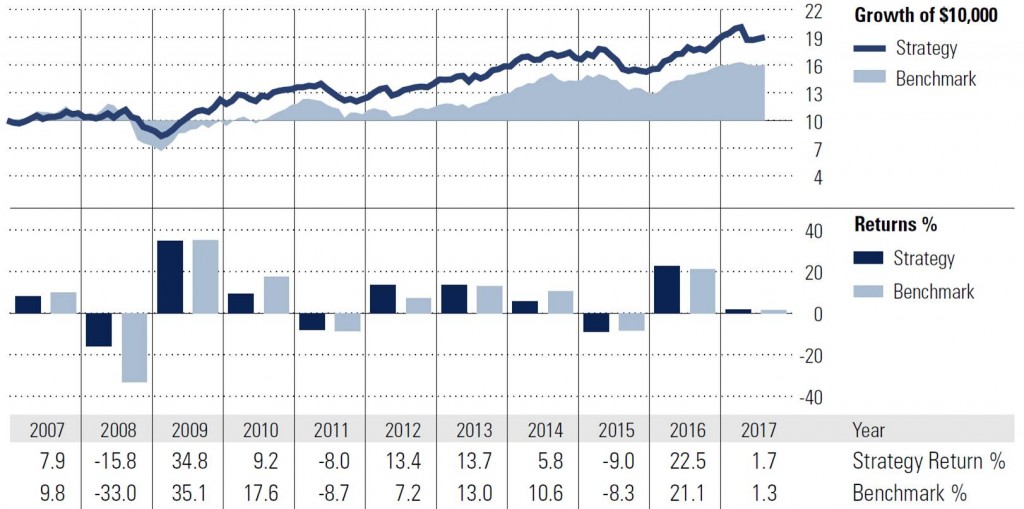

I used Morningstar CPMS to back test this strategy from December 1985, to August 2017. During this process, 10 stocks were purchased and equally weighted with a maximum of three stocks per economic sector. Once a quarter, we used dividend proceeds to re-balance stocks back to their equally weighted target. Over this period, the strategy produced an annualized total return of 11.2% while the S&P/TSX Composite Total Return Index returned 8.1%.

The below table shows a clear picture of how such a strategy performed in trailing periods:

| Return % | Standard Deviation % | Downside Deviation % | Sharpe Ratio % | ||||||||

| Strategy % | Benchmark % | Net % | Strategy | Benchmark | Strategy | Benchmark | Strategy | Benchmark | Alpha | Beta | |

| Since Inception | 11.19 | 8.12 | 3.07 | 10.71 | 14.37 | 6.61 | 10.04 | 0.63 | 0.26 | 0.59 | 0.47 |

| 1-Yr Return | 8.08 | 7.23 | 0.85 | ||||||||

| 3-Yr Return | 3.3 | 2.1 | 1.2 | 9.38 | 7.69 | 6.55 | 5.11 | 0.29 | 0.2 | 0.13 | 0.88 |

| 5-Yr Return | 7.19 | 8.13 | -0.95 | 8.6 | 7.55 | 5.53 | 4.43 | 0.75 | 0.98 | 0.07 | 0.79 |

| 10-Yr Return | 6.23 | 4.1 | 2.12 | 10.61 | 13.38 | 7.02 | 9.89 | 0.5 | 0.23 | 0.33 | 0.54 |

| 15-Yr Return | 8.71 | 8.54 | 0.17 | 9.91 | 12.42 | 6.25 | 8.6 | 0.71 | 0.55 | 0.34 | 0.54 |

| 20-Yr Return | 10.68 | 6.74 | 3.94 | 10.96 | 14.75 | 6.85 | 10.53 | 0.76 | 0.3 | 0.64 | 0.41 |

The stocks that qualify for purchase into the strategy today are listed in the table below. As always, it is advised that investors conduct their own independent research before buying or selling any security.

| Rank | Symbol | 5Y Historic Beta | Earnings Variability | Expected Dividend Yield (%) |

| 1 | BCE Inc. (BCE) | 0.26 | 2.65 | 4.92 |

| 2 | AltaGas Ltd. (ALA) | 0.77 | 10.68 | 7.28 |

| 3 | IGM Financial Inc. (IGM) | 1.31 | 3.17 | 5.36 |

| 4 | Capital Power Corp (CPX) | 0.84 | 8.82 | 6.63 |

| 5 | Power Financial Corp. (PWF) | 1.00 | 3.11 | 4.78 |

| 6 | Cdn Imperial Bank (CM) | 1.07 | 3.06 | 4.77 |

| 7 | Enbridge IF Holdings (ENF) | 0.79 | 9.66 | 6.4 |

| 8 | North West Company Inc. (NWC) | -0.12 | 5.46 | 4.22 |

| 9 | Emera Inc. (EMA) | -0.04 | 8.89 | 4.45 |

| 10 | TELUS Corporation (T) | 0.74 | 4.27 | 4.38 |

Morningstar Research Inc. provides independent investment research in North America, Europe, Australia and Asia. Its research tool, Morningstar CPMS, provides quantitative North American equity research and portfolio analysis to institutional clients and financial advisers. CPMS data cover more than 95 per cent of the investable North American stock market. With more than 110 equity and credit analysts, Morningstar has one of the largest independent institutional equity research teams in the world.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email

The earnings variability is one I use a lot. Actually works very well to find short stocks if you use standard deviation of analyst forecasts instead of a trailing number. Problem is that CPMS is shutting down in Dec 2023 and there are few alternatives. I use Portfolio123 which has Canadian data (Factset). Have you found any other screening/backtesting platforms? US has so many options but in Canada we are lagging.