15 stocks to help investors ride market swings

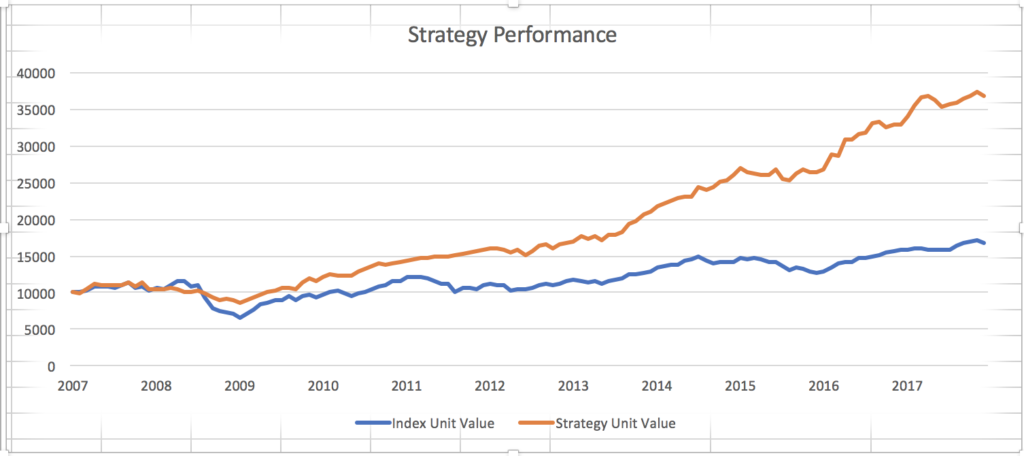

Volatility won’t be going away anytime soon but there are ways to mitigate risk

Advertisement

Volatility won’t be going away anytime soon but there are ways to mitigate risk

You can find the strategy’s latest 15 stock picks below based on February month-end data.

You can find the strategy’s latest 15 stock picks below based on February month-end data.

| Rank | Symbol | Company | Sector | 5Y Dividend Growth Rate | Yield | Expected Dividend Growth | BETA | Market Cap (in $millions) |

| 1 | MFI | Maple Leaf Foods Inc. | Consumer Staples | 33.5% | 1.6% | 18.2% | 0.59 | $4,109 |

| 2 | GIL | Gildan Activewear | Consumer Discretionary | 28.3% | 1.5% | 19.8% | 0.58 | $8,159 |

| 3 | HWD | Hardwoods Dist. Inc. | Industrials | 20.4% | 1.5% | 16.0% | 0.45 | $406 |

| 4 | MRU | Metro Inc. | Consumer Staples | 19.2% | 1.8% | 10.8% | -0.07 | $9,218 |

| 5 | ENB | Enbridge Inc. | Energy | 19.0% | 6.6% | 11.2% | 0.74 | $69,173 |

| 6 | CTC.A | Cdn Tire Corp. Ltd. | Consumer Discretionary | 17.4% | 2.1% | 38.5% | 0.74 | $11,552 |

| 7 | BIP.UN | Brookfield Inf Partner | Utilities | 20.7% | 4.6% | 8.0% | 0.64 | $14,274 |

| 8 | CGO | COGECO Inc. | Consumer Discretionary | 15.6% | 2.2% | 10.6% | 0.64 | $1,053 |

| 9 | NFI | New Flyer Industries | Industrials | 12.5% | 2.3% | 15.6% | 0.20 | $3,587 |

| 10 | BAM.A | Brookfield Asset Mgmt | Financials | 18.0% | 1.5% | 7.1% | 0.67 | $49,246 |

| 11 | CU | Cdn Utilities Ltd., A | Utilities | 10.2% | 4.6% | 10.0% | 0.52 | $9,188 |

| 12 | IIP.UN | InterRent REIT | Real Estate | 10.1% | 2.8% | 9.1% | 0.59 | $806 |

| 13 | IFC | Intact Financial Corp. | Financials | 9.8% | 2.8% | 9.4% | 0.49 | $13,815 |

| 14 | BEP.UN | Brookfield Renewable | Utilities | 16.4% | 6.2% | 6.1% | 0.03 | $7,151 |

| 15 | SXP | Supremex Inc. | Materials | 15.6% | 6.0% | 6.1% | 0.38 | $124 |

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email