Why you’re getting a tax break on dividend income

In some provinces, you may not have to pay any taxes at all

Advertisement

In some provinces, you may not have to pay any taxes at all

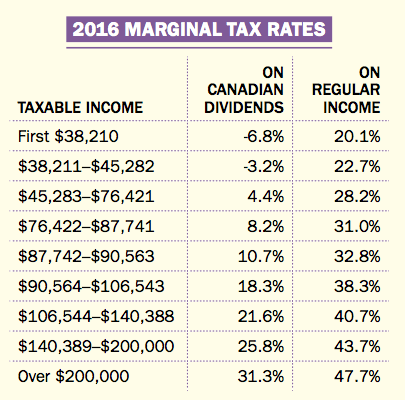

Note that Canadian dividends will get you a nice tax break at all income levels, but the benefit is especially large if you’re in a lower tax bracket.

Amazingly, if you’re in a low enough tax bracket in some provinces (including B.C.), you not only pay no taxes on dividend income at all, but the dividends cause a further small reduction in the rest of your taxes. This is a rare and delightful example of a “negative marginal tax rate”.

The actual calculations are pretty complex and go through a three-step process. First, dividends received are grossed up and included in taxable income. Second, a percentage tax rate is applied and, third, you receive a dividend tax credit which knocks your net taxes back down. The positive impact of the dividend tax credit is greater than the negative impact of the gross up.

A further complication to consider is that while dividend income is taxed favourably, it hurts you when it comes to income-tested government benefits such as the Old Age Security clawback. That’s because the income test incorporates grossed-up income—step one of the three-part process—not the dividends you actually receive.

Related: How to buy dividend stocks

Note that Canadian dividends will get you a nice tax break at all income levels, but the benefit is especially large if you’re in a lower tax bracket.

Amazingly, if you’re in a low enough tax bracket in some provinces (including B.C.), you not only pay no taxes on dividend income at all, but the dividends cause a further small reduction in the rest of your taxes. This is a rare and delightful example of a “negative marginal tax rate”.

The actual calculations are pretty complex and go through a three-step process. First, dividends received are grossed up and included in taxable income. Second, a percentage tax rate is applied and, third, you receive a dividend tax credit which knocks your net taxes back down. The positive impact of the dividend tax credit is greater than the negative impact of the gross up.

A further complication to consider is that while dividend income is taxed favourably, it hurts you when it comes to income-tested government benefits such as the Old Age Security clawback. That’s because the income test incorporates grossed-up income—step one of the three-part process—not the dividends you actually receive.

Related: How to buy dividend stocks

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email