A dividend paying ETF portfolio to last a lifetime

Retired investor June Haist has a six-figure inheritance and a low-cost portfolio she started managing herself three years ago. She’s now wondering whether her money will last her to 95

Advertisement

Retired investor June Haist has a six-figure inheritance and a low-cost portfolio she started managing herself three years ago. She’s now wondering whether her money will last her to 95

![Portfolio_Builder_banner_1256X300[2][2][2]](https://www.moneysense.ca/wp-content/uploads/2016/05/Portfolio_Builder_banner_1256X300222.jpeg)

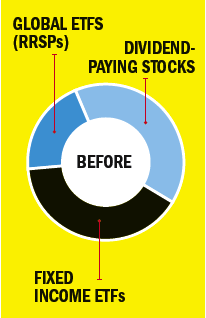

THE PROBLEM

For years, June worked sporadically and earned little. But when her mother passed away three years ago, she received a large six-figure inheritance and retired. On her own, June selected 28 dividend-paying stocks and three fixed-income ETFs for the non-registered portion of her portfolio. Equity ETFs went into her RRSP and TFSA (she could put only a small amount in those tax-sheltered accounts due to limited contribution room). “I want a simple portfolio with low fees,” says June. But she’s worried it may not last to age 95. She’ll need to withdraw $18,000 annually to live comfortably and be able to travel.

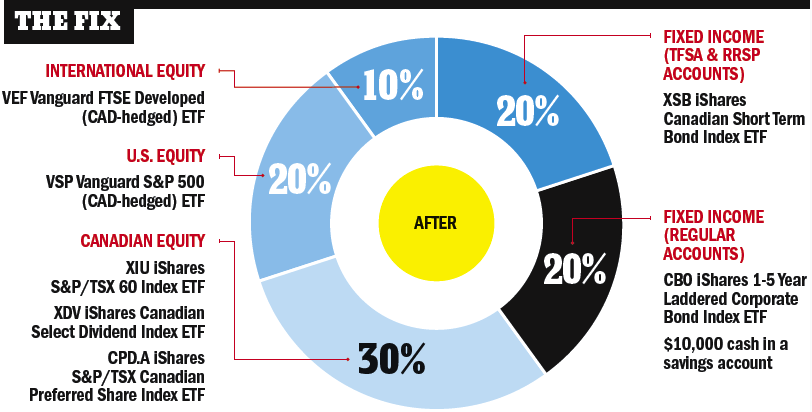

THE FIX

Certified financial planner Ayana Forward, of Ryan Lamontagne Inc. in Ottawa, says June needs to optimize her tax efficiency and maintain a 60-40 split between her equity and fixed-income investments if she wants her money to last. Simplifying her holdings will make budgeting easier, too. “She doesn’t need 28 different dividend-paying stocks,” says Forward. “She should invest entirely in ETFs, with the largest portion going to an ETF that will pay dividends out monthly into her savings account.”

For maximum tax efficiency June should hold fixed-income ETFs inside her RRSP and TFSA, since income from these investments is taxed more heavily than dividends. But only half of June’s fixed-income asset allocation will fit in her registered accounts because she’s maxed out her contribution room, so the rest will have to go in a regular account, along with the equity-based ETFs that make up the stock portion of her portfolio. Forward notes that 4% average annual returns are all June needs to make her funds last, and this portfolio will provide that to her. She adds that June should transition to the new portfolio over two years, to minimize the capital gains tax she’ll have to pay when she sells her current stocks.

Finally, Forward suggests $10,000 should be left in a savings account to be used for emergencies or travel. “She should replenish that cash annually as she uses it up.” Rebalancing once a year and reducing her withdrawals at age 65, when Old Age Security and CPP ramp up, will keep June on track.

THE PROBLEM

For years, June worked sporadically and earned little. But when her mother passed away three years ago, she received a large six-figure inheritance and retired. On her own, June selected 28 dividend-paying stocks and three fixed-income ETFs for the non-registered portion of her portfolio. Equity ETFs went into her RRSP and TFSA (she could put only a small amount in those tax-sheltered accounts due to limited contribution room). “I want a simple portfolio with low fees,” says June. But she’s worried it may not last to age 95. She’ll need to withdraw $18,000 annually to live comfortably and be able to travel.

THE FIX

Certified financial planner Ayana Forward, of Ryan Lamontagne Inc. in Ottawa, says June needs to optimize her tax efficiency and maintain a 60-40 split between her equity and fixed-income investments if she wants her money to last. Simplifying her holdings will make budgeting easier, too. “She doesn’t need 28 different dividend-paying stocks,” says Forward. “She should invest entirely in ETFs, with the largest portion going to an ETF that will pay dividends out monthly into her savings account.”

For maximum tax efficiency June should hold fixed-income ETFs inside her RRSP and TFSA, since income from these investments is taxed more heavily than dividends. But only half of June’s fixed-income asset allocation will fit in her registered accounts because she’s maxed out her contribution room, so the rest will have to go in a regular account, along with the equity-based ETFs that make up the stock portion of her portfolio. Forward notes that 4% average annual returns are all June needs to make her funds last, and this portfolio will provide that to her. She adds that June should transition to the new portfolio over two years, to minimize the capital gains tax she’ll have to pay when she sells her current stocks.

Finally, Forward suggests $10,000 should be left in a savings account to be used for emergencies or travel. “She should replenish that cash annually as she uses it up.” Rebalancing once a year and reducing her withdrawals at age 65, when Old Age Security and CPP ramp up, will keep June on track.

Do you want a portfolio makeover from MoneySense? If so, send an email describing your situation to [email protected]

Do you want a portfolio makeover from MoneySense? If so, send an email describing your situation to [email protected]

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email