Am I on track to retire at age 60?

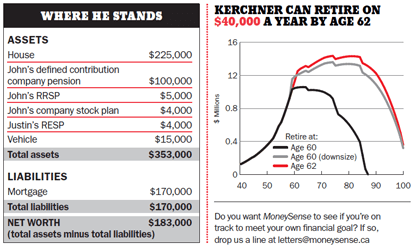

John Kerchner hopes to retire early and live off $40,000 a year.

Advertisement

John Kerchner hopes to retire early and live off $40,000 a year.

Do you want MoneySense to see if you’re on track to meet your own financial goals? If so, drop us a line at [email protected]

(Photograph by John Zada)

Do you want MoneySense to see if you’re on track to meet your own financial goals? If so, drop us a line at [email protected]

(Photograph by John Zada)

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email