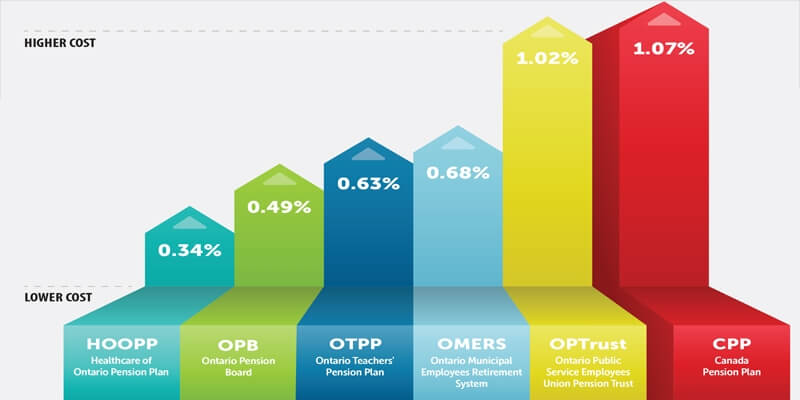

CPP more costly than other public sector pensions

As the largest plan, it also has the highest expense ratio

Advertisement

As the largest plan, it also has the highest expense ratio

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email