Half of Ontarians may not have to save for retirement

New figures show that if Kathleen Wynne's Ontario Pension Plan is adopted, up to 50% of residents won't have to save a penny

Advertisement

New figures show that if Kathleen Wynne's Ontario Pension Plan is adopted, up to 50% of residents won't have to save a penny

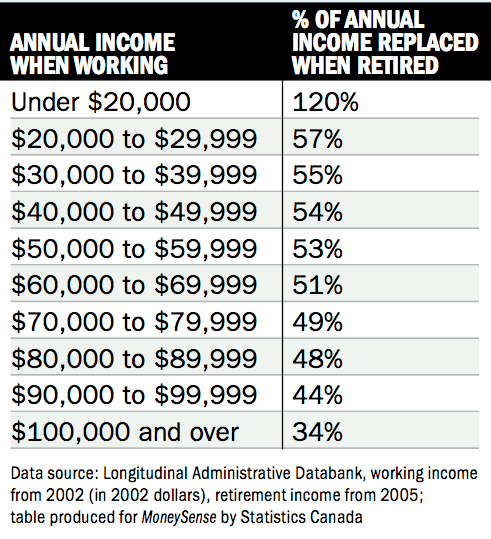

This will provide an income that is as good or better than what they are earning in retirement now, as Statistics Canada research shows (see table) that the average Canadian earning $20,000 or more when working replaces less than 57% of his or her working income in retirement, due to lower living costs.

Those who earn more in their working years will find the gap harder to close, even with the ORPP. Anyone in this situation will either have to save more or be forced to scale down their lifestyle in retirement.

Unfortunately, those are exactly the people who are facing the real savings crisis in the first place. “My estimate is that 15% to 20% of them are going to be retiring with inadequate pensions,” says Vettese. “They will have a more than 20% drop in their disposable income in retirement.”

Associate Minister of Finance Mitzie Hunter, who is overseeing the ORPP, was not made available for an interview, but in a letter to MoneySense she wrote that the ORPP “is not a replacement to personal or voluntary savings, which are still an important and essential part of the retirement income system” but rather “a secure retirement income floor for workers in the province.”

She also stated that the preferred solution is still a Canada Pension Plan enhancement, something Prime Minister Stephen Harper has so far refused, forcing Premier Kathleen Wynne’s hand to create this “made-in-Ontario” solution.

Retirement experts agree that the ORPP will help vulnerable Ontarians, but its current form it will also have some unintended consequences. It will reduce personal savings rates in important vehicles such as RRSPs and TFSAs, and could result in lower wages and watered down defined-contribution pension plans down the road as employers struggle to pay into the ORPP. It could also hurt very low income Canadians by causing clawbacks in their GIS payments when they retire, forcing them to save more while they are working to get the same retirement income.

“Overall, we are a little better off with the ORPP as it is currently envisioned but the plan design is still far from being optimized,” Vettese said.

More ORPP facts & figures »

This will provide an income that is as good or better than what they are earning in retirement now, as Statistics Canada research shows (see table) that the average Canadian earning $20,000 or more when working replaces less than 57% of his or her working income in retirement, due to lower living costs.

Those who earn more in their working years will find the gap harder to close, even with the ORPP. Anyone in this situation will either have to save more or be forced to scale down their lifestyle in retirement.

Unfortunately, those are exactly the people who are facing the real savings crisis in the first place. “My estimate is that 15% to 20% of them are going to be retiring with inadequate pensions,” says Vettese. “They will have a more than 20% drop in their disposable income in retirement.”

Associate Minister of Finance Mitzie Hunter, who is overseeing the ORPP, was not made available for an interview, but in a letter to MoneySense she wrote that the ORPP “is not a replacement to personal or voluntary savings, which are still an important and essential part of the retirement income system” but rather “a secure retirement income floor for workers in the province.”

She also stated that the preferred solution is still a Canada Pension Plan enhancement, something Prime Minister Stephen Harper has so far refused, forcing Premier Kathleen Wynne’s hand to create this “made-in-Ontario” solution.

Retirement experts agree that the ORPP will help vulnerable Ontarians, but its current form it will also have some unintended consequences. It will reduce personal savings rates in important vehicles such as RRSPs and TFSAs, and could result in lower wages and watered down defined-contribution pension plans down the road as employers struggle to pay into the ORPP. It could also hurt very low income Canadians by causing clawbacks in their GIS payments when they retire, forcing them to save more while they are working to get the same retirement income.

“Overall, we are a little better off with the ORPP as it is currently envisioned but the plan design is still far from being optimized,” Vettese said.

More ORPP facts & figures »

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email