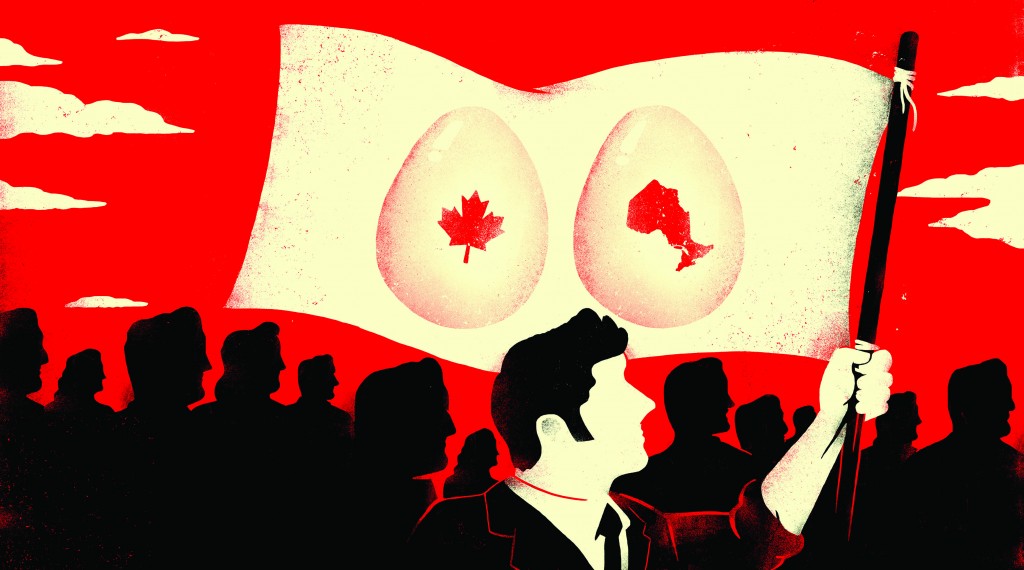

How Wynne’s ORPP will change savings habits

If Ontario implements its new provincial pension plan, many residents won’t have to save a cent for retirement

Advertisement

If Ontario implements its new provincial pension plan, many residents won’t have to save a cent for retirement

66% Workers in Ontario not enrolled in a workplace pension plan Source: Ontario Ministry of Finance“I think a mandatory savings program makes sense,” says pension policy expert Bob Baldwin. But he’s less sure the province will be able to deliver on its promise of predictable benefits, indexed to inflation. Under the plan, a worker making $70,000 would get a retirement income of $9,970 a year for life, and that’s on top of payments from the Canada Pension Plan (CPP) and Old Age Security (OAS). Combined, the ORPP, CPP and OAS could theoretically replace 55% of a middle-class retiree’s pre-retirement income. That’s enough to maintain almost the same standard of living they enjoyed while they were working, due to lower living costs in retirement. The problem is, salaries could suffer as employers struggle to top up workers’ ORPP accounts. “Most employers can’t afford to pay the 1.9%,” says Baldwin. “That will lead to lower wages down the road.” As well, Ontarians will have less control over their retirement savings and how they are invested. Baldwin, for one, says that could actually be a benefit though, as it will make workers less reliant on overpriced mutual funds and expensive advisers. “The return on investment will be better than with the typical RRSP,” he says, “due to the lower costs.” More ORPP facts & figures »

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email