RRIF withdrawals: How to calculate your rate

Make it last and shrink your tax

Advertisement

Make it last and shrink your tax

Q: I am turning 71 this year and I will be converting my RRSP to a RRIF. I understand I have an option to withdraw a lesser amount since my wife is six years younger. How do I calculate what percentage I will need to withdraw from my RRIF at age 72 considering my wife’s age—she will be 66.

—Bruce

A: Minimizing the mandatory portion of the RRIF withdrawal is a good strategy to maximize income flexibility. Bruce can choose the age 66 (spouse’s age) minimum withdrawal schedule making him effectively six years younger for the purpose of calculating the minimum withdrawal amount. Bruce must convert his RRSP to a RRIF by the end of the year he turns age 71 which is 2017.

Bruce’s age at the beginning of the year becomes his age for the entire year for withdrawal purposes so he is considered to be age 71 in 2018 and then age 72 in 2019. Bruce must note the RRIF balance at the beginning of the year for the purpose of calculating the minimum amount for that year.

| Year | Bruce’s age at beginning of year | Bruce’s age for RRIF minimum | RRSP/RRIF balance at the beginning of the year | Minimum withdrawal rate | Minimum withdrawal amount |

| 2017 | Year Bruce converts his RRSP to a RRIF | ||||

| 2018 | 71 | 65 | $100,000 | 4.00% | $4,000 |

| 2019 | 72 | 66 | $100,000 | 4.17% | $4,167 |

| 2020 | 73 | 67 | $100,000 | 4.35% | $4,348 |

Bruce’s first annual minimum withdrawal amount would be $4,000 if his balance on Jan 1, 2018 is $100,000.

The focus of retirement income planning should not be solely on the legislated minimum withdrawal schedule.

The most effective way to minimize tax on RRSP/RRIF withdrawals, in the long run, is to slip to the lower federal and provincial tax brackets. By withdrawing over a sufficient number of years you can reduce your rate of tax on income and match to your personal life expectancy. For some, an RRSP/RRIF withdrawal schedule from age 60 to 90 is ideal, for others, a schedule from age 65 to 85 is the best fit.

There is a pension credit starting at age 65 that lowers your taxable income on eligible pensions. RSP is not eligible—RIF is eligible as a pension. Some may need to convert at least $2,000 to a RIF starting at age 65 to take advantage of this tax savings if they do not have other eligible pension income.

Those of us with sufficient resources to retire early will find it reasonable to withdraw some RSP funds as an income bridge until CPP & OAS start. This again spreads out the taxable income landing them in lower tax brackets.

Work with a retirement planner to develop a custom withdrawal schedule that fits your specific financial resources and retirement outlook.

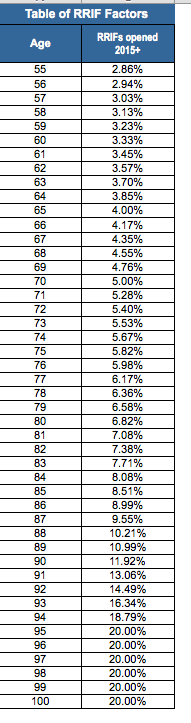

The mandatory age to convert an RRSP to a RRIF is an arbitrary setting set by the government that applies to everyone in the absence of their own withdrawal schedule. The government has simply created a universal “latest” withdrawal schedule. You must start withdrawing at the latest age of 71 and the funds will be depleted at around age 98 if you follow the minimum schedule exactly. You can’t side-step the tax on RRIF income if you happen to die earlier as your estate will pay up in a final tax payment all at once at a higher tax rate. See full table.

MORE:

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email

I am 73 years old widow born in Jan 15 1947. I have 91000.00 RIF in CDN dollars. How much I have to withdraw for the year 2020 and how much tax I have to pay.

Response from the MoneySense editorial team:

Hi Indranee, thank you for asking.

Due to the large volume of comments we receive, we regret that we are unable to respond directly to each one. We invite you to email your question to [email protected],

where it will be considered for a future response by one of our expert columnists. For personal advice, we suggest consulting with your financial institution or a qualified advisor.

I have RRSPs worth $500,000 and I am age 67. I now live in the US and do understand when I hav e to covert to a RRIF and withdraw. How will my annual RRIF distributions be taxed in Canada if I still am a US resident?

Due to the large volume of comments we receive, we regret that we are unable to respond directly to each one. We invite you to email your question to [email protected], where it will be considered for a future response by one of our expert columnists. For personal advice, we suggest consulting with your financial institution or a qualified advisor.

I am just widowed and I would like to know what to do with my husband’s rifle account to get the most out of it. I am 70 years old. Thank you.

Thank you for the question and we apologize for your loss. We invite you to email your question to [email protected], where it will be considered for a future response by one of our expert columnists. For personal advice, we suggest consulting with your financial institution or a qualified advisor.

My husband died in July 2021 and I was left with his RRIF’s and investments, do I have to pay taxes on them?