5 rules to pay less tax

Don't sweat the fine print and keep more of your money

Advertisement

Don't sweat the fine print and keep more of your money

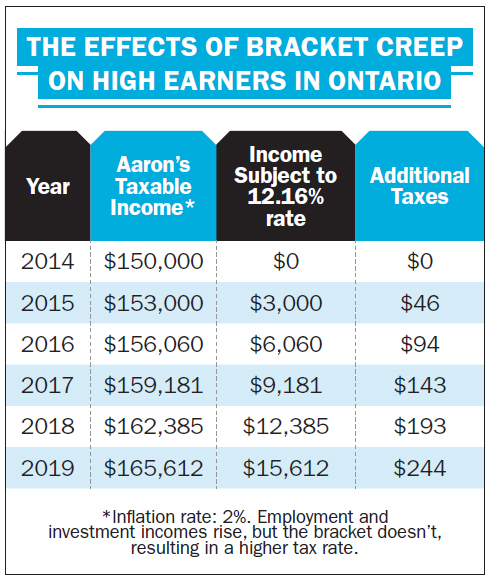

The table above explains how this works against Aaron, a high income earner in Ontario. His salary is $140,000 and it’s indexed to inflation, plus he has $10,000 in investment income. The rate of tax he pays to the Ontario government on his next taxable dollar is 11.16%. Ontario recently introduced a new 12.16% rate, but right now, Aaron’s income is below the threshold. Unfortunately, not for long: as his income rises due to inflation, he will have to pay tax at a higher rate because of bracket creep.

Luckily there are three ways for astute savers like Aaron to fight back: With good tax planning, you can eliminate the tax on investment income using a TFSA (Tax-Free Savings Account), defer tax on employment income with an RRSP (Registered Retirement Savings Plan), and diversify and split income sources by transferring investment income to your spouse.

4. Reduce taxes as a family. Because we have a progressive tax system, the more you earn the more you pay. As well, different income sources attract different marginal tax rates. But when multiple income sources are earned by several taxpayers in the family, instead of just one, the household can successfully average taxes downward. Family income splitting is an important principle in tax-efficient wealth management—so do your tax planning as a family to fund important family milestones. An RESP (Registered Education Savings Plan) can be helpful here in transferring investment earnings to the university-bound.

5. Borrow wisely. When it comes to interest, you’ll be richer if you earn it, instead of paying it. But, if you must pay interest, make sure it’s deductible. Arrange your affairs to pay off non-deductible debt, like consumer credit cards and home mortgages. Then use your stronger cash flow position to invest in income-producing assets, like securities held in non-registered accounts, a rental property, or a business.

Remember, time is your most precious resource in beating wealth eroders like taxes, inflation, and non-deductible interest costs. Learning more about taxes will help you understand and execute your investment goals and tap into the wealth of knowledge your professional advisory team has. The best news? Those professional fees could be tax-deductible, too.

Evelyn Jacks is president of Knowledge Bureau, which offers e-learning at knowledgebureau.com. Evelyn tweets @evelynjacks and blogs at evelynjacks.com.

The table above explains how this works against Aaron, a high income earner in Ontario. His salary is $140,000 and it’s indexed to inflation, plus he has $10,000 in investment income. The rate of tax he pays to the Ontario government on his next taxable dollar is 11.16%. Ontario recently introduced a new 12.16% rate, but right now, Aaron’s income is below the threshold. Unfortunately, not for long: as his income rises due to inflation, he will have to pay tax at a higher rate because of bracket creep.

Luckily there are three ways for astute savers like Aaron to fight back: With good tax planning, you can eliminate the tax on investment income using a TFSA (Tax-Free Savings Account), defer tax on employment income with an RRSP (Registered Retirement Savings Plan), and diversify and split income sources by transferring investment income to your spouse.

4. Reduce taxes as a family. Because we have a progressive tax system, the more you earn the more you pay. As well, different income sources attract different marginal tax rates. But when multiple income sources are earned by several taxpayers in the family, instead of just one, the household can successfully average taxes downward. Family income splitting is an important principle in tax-efficient wealth management—so do your tax planning as a family to fund important family milestones. An RESP (Registered Education Savings Plan) can be helpful here in transferring investment earnings to the university-bound.

5. Borrow wisely. When it comes to interest, you’ll be richer if you earn it, instead of paying it. But, if you must pay interest, make sure it’s deductible. Arrange your affairs to pay off non-deductible debt, like consumer credit cards and home mortgages. Then use your stronger cash flow position to invest in income-producing assets, like securities held in non-registered accounts, a rental property, or a business.

Remember, time is your most precious resource in beating wealth eroders like taxes, inflation, and non-deductible interest costs. Learning more about taxes will help you understand and execute your investment goals and tap into the wealth of knowledge your professional advisory team has. The best news? Those professional fees could be tax-deductible, too.

Evelyn Jacks is president of Knowledge Bureau, which offers e-learning at knowledgebureau.com. Evelyn tweets @evelynjacks and blogs at evelynjacks.com.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email

Just wanted to ask if there are any tools to use in order to not pay as much tax as I am paying right now?

I work with a company as an employee

But I pay too much tax and it’s not fare.

Due to the large volume of comments we receive, we regret that we are unable to respond directly to each one. We invite you to email your question to [email protected], where it will be considered for a future response by one of our expert columnists. For personal advice, we suggest consulting with your financial institution or a qualified advisor.