TFSAs for young savers

Just launching your career? TFSAs offer flexibility for both short- and long-term goals

Advertisement

Just launching your career? TFSAs offer flexibility for both short- and long-term goals

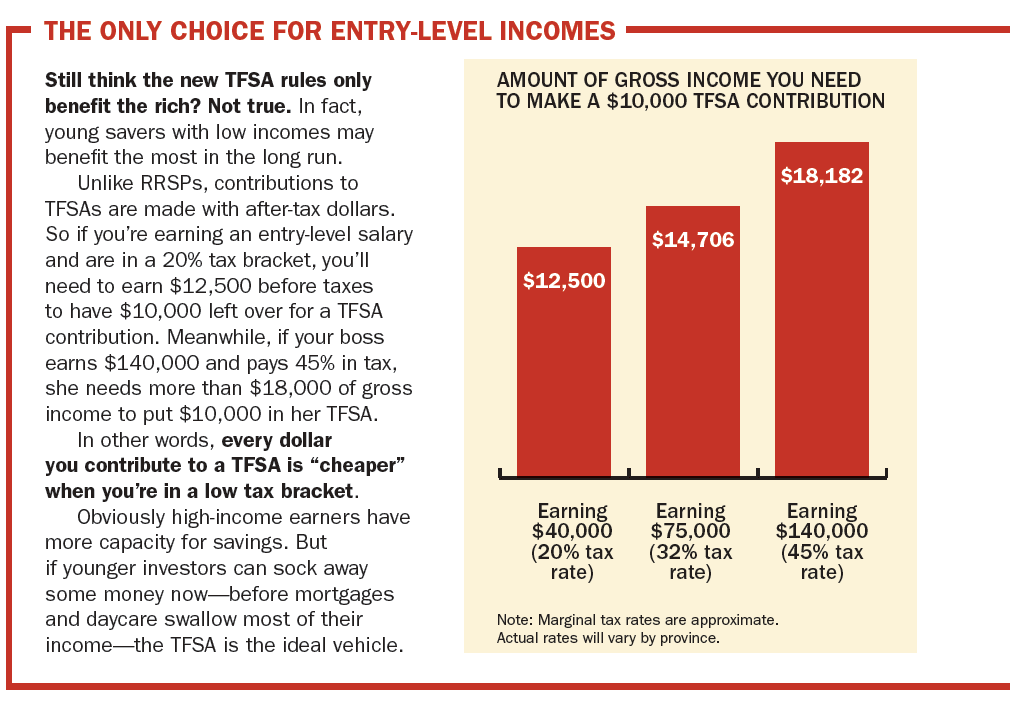

Another benefit of the TFSA to young savers is that the tax savings comes when you draw down the account in retirement rather than when you make the contribution. The RRSP is almost a no-brainer for Canadians in the highest tax bracket, since their immediate refund can be close to 50% and it’s unlikely they’ll pay more tax than that in retirement. But for folks earning a modest income now with the expectation of more in the future, the TFSA is usually a better way to save: even though they forgo the immediate refund when money goes in, there’s a larger tax savings when they take it out.

Let’s consider someone like Blair who’s earning $40,000 at the beginning of his career, putting him in Ontario’s lowest tax bracket. Contributing 18% of his income ($7,200 annually) would net him a tax refund of about 20%, or $1,444. But when he later withdraws that money in retirement he’ll pay tax on it, and it’s quite likely he’ll no longer be in the lowest tax bracket. He might be receiving Canada Pension Plan (CPP) and Old Age Security (OAS) benefits, and maybe an employer pension, rental income or dividends from a business he owns. If he has a 32% marginal tax rate in retirement, a $7,200 withdrawal would result in a tax bill of $2,304—over 50% more than his original refund. The lesson here is that if you’re in a higher tax bracket when you withdraw your savings than when you contributed, RRSPs are the wrong vehicle.

Now consider how the TFSA benefits Canadians who are expecting to earn higher incomes in the future. By contributing $7,200 to a TFSA instead of an RRSP, someone in a 20% tax bracket forfeits the $1,444 refund this year, but his savings will not be taxable when they’re ultimately withdrawn. If you’re in a 32% tax bracket in retirement, you would avoid that potential $2,304 tax bill you’d otherwise pay, so your net savings is $860. Moreover, the TFSA withdrawal won’t affect income-tested government benefits like OAS.

Another benefit of the TFSA to young savers is that the tax savings comes when you draw down the account in retirement rather than when you make the contribution. The RRSP is almost a no-brainer for Canadians in the highest tax bracket, since their immediate refund can be close to 50% and it’s unlikely they’ll pay more tax than that in retirement. But for folks earning a modest income now with the expectation of more in the future, the TFSA is usually a better way to save: even though they forgo the immediate refund when money goes in, there’s a larger tax savings when they take it out.

Let’s consider someone like Blair who’s earning $40,000 at the beginning of his career, putting him in Ontario’s lowest tax bracket. Contributing 18% of his income ($7,200 annually) would net him a tax refund of about 20%, or $1,444. But when he later withdraws that money in retirement he’ll pay tax on it, and it’s quite likely he’ll no longer be in the lowest tax bracket. He might be receiving Canada Pension Plan (CPP) and Old Age Security (OAS) benefits, and maybe an employer pension, rental income or dividends from a business he owns. If he has a 32% marginal tax rate in retirement, a $7,200 withdrawal would result in a tax bill of $2,304—over 50% more than his original refund. The lesson here is that if you’re in a higher tax bracket when you withdraw your savings than when you contributed, RRSPs are the wrong vehicle.

Now consider how the TFSA benefits Canadians who are expecting to earn higher incomes in the future. By contributing $7,200 to a TFSA instead of an RRSP, someone in a 20% tax bracket forfeits the $1,444 refund this year, but his savings will not be taxable when they’re ultimately withdrawn. If you’re in a 32% tax bracket in retirement, you would avoid that potential $2,304 tax bill you’d otherwise pay, so your net savings is $860. Moreover, the TFSA withdrawal won’t affect income-tested government benefits like OAS.

STAY FLEXIBLE

Finally, the TFSA’s flexibility makes it ideal for young Canadians whose future includes more than just retirement. RRSPs were designed specifically to help Canadians save money and defer taxes while they were working and use that money to fund their senior years. You can withdraw the money early if you need to, but you’ll pay withholding taxes of up to 30% (these may be recoverable) and you’ll never get that contribution room back. Programs such as the Home Buyers’ Plan and the Lifelong Learning Plan allow you to borrow from your RRSP and pay it back according to a fixed schedule—and these are still useful for those who have already socked away money in their retirement plans. But the TFSA has largely made them obsolete for younger savers.

With a TFSA you can tap your savings at any time without tax consequences, and your contribution room is restored on January 1 of the following year. You don’t even lose the additional room created by the growth of your investments. Say you maxed out your TFSA at $41,000 early this year and the investments grew to $45,000. If you withdraw that money today, you’d be able to recontribute the whole $45,000 next year. These features makes the TFSA ideal for young people saving for a down payment, a new car, a wedding, grad school or any other medium-term goal.

Blair Stiver isn’t sure exactly what the future holds in terms of career, family, home ownership and retirement. But he’s confident that his tax-free savings will give him the freedom to meet all of his goals. “I view the TFSA as possibly the only account I will ever use.”

STAY FLEXIBLE

Finally, the TFSA’s flexibility makes it ideal for young Canadians whose future includes more than just retirement. RRSPs were designed specifically to help Canadians save money and defer taxes while they were working and use that money to fund their senior years. You can withdraw the money early if you need to, but you’ll pay withholding taxes of up to 30% (these may be recoverable) and you’ll never get that contribution room back. Programs such as the Home Buyers’ Plan and the Lifelong Learning Plan allow you to borrow from your RRSP and pay it back according to a fixed schedule—and these are still useful for those who have already socked away money in their retirement plans. But the TFSA has largely made them obsolete for younger savers.

With a TFSA you can tap your savings at any time without tax consequences, and your contribution room is restored on January 1 of the following year. You don’t even lose the additional room created by the growth of your investments. Say you maxed out your TFSA at $41,000 early this year and the investments grew to $45,000. If you withdraw that money today, you’d be able to recontribute the whole $45,000 next year. These features makes the TFSA ideal for young people saving for a down payment, a new car, a wedding, grad school or any other medium-term goal.

Blair Stiver isn’t sure exactly what the future holds in terms of career, family, home ownership and retirement. But he’s confident that his tax-free savings will give him the freedom to meet all of his goals. “I view the TFSA as possibly the only account I will ever use.”

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email