Whether you’re new to credit cards or an occasional card user trying to avoid hefty fees, no-fee credit cards don’t need to mean no rewards. Many of our top picks for no-fee credit cards in Canada come with rewards and other perks like insurance coverage and discounts.

The best no-fee credit cards in Canada

Need a credit card with no yearly fee? Compare card details of our top picks in this category.

SimplyCash Card from American Express

Home Trust Preferred Visa

American Express Green Card

| Award | Card | Annual fee | Rewards | Income requirement | Recommended credit score | Apply |

|---|---|---|---|---|---|---|

| Gold: Best no-fee cash back credit card | SimplyCash Card from American Express | $0 | At least 1.25% cash back on all purchases | None specified | 725 or higher | Apply |

| Silver: Best no-fee cash back credit card | Tangerine Money-Back Credit Card | $0 | 2% cash back in up to 3 categories of your choice | $12,000 (household or personal) | 660 or higher | n/a |

| Gold: Best no-fee travel credit card | American Express Green Card | $0 | 1 Amex Membership Rewards point per $1 spent | None specified | 725 or higher | Apply |

| Gold: Best for no foreign transaction fees | Home Trust Preferred Visa | $0 | 1% cash back on all Canadian purchases | None specified | 660 or highe | Apply |

| Gold: Best no-fee, low-interest card | Desjardins Flexi Visa | $0 | None | None specified | 660 or higher | n/a |

| Gold: Best no-fee secured card | Home Trust Secured Visa | $0 | None | None specified | No credit required | n/a |

Best for cash back: American Express SimplyCash Card

As the name suggests, the SimplyCash Card from American Express keeps things simple—and rewarding. The 1.25% base earn rate is among the most generous available in Canada, and it only gets sweeter from there with 2% back on gas and grocery purchases, making this the best no-fee cash back card in the country.

SimplyCash from American Express

Annual fee: $0

- 2% cash back on gas and groceries

- 1.25% cash back on all other purchases

Welcome offer: Earn a bonus 5% cash back on your first $2,000 in purchases during your first three months (up to $100 in bonus cash back).

Card details

| Interest rates | 21.99% on purchases, 21.99% on cash advances, penalty APR on purchases and cash advances (rates are variable) |

| Income required | None specified |

| Credit score | 725 or higher |

Pros

- Generous base earn rate: Most no-fee cash back credit cards in Canada have a base earn rate of 0.5%. With this card, you get at least a full percentage more on all your purchases.

- Travel insurance benefits: Many no-fee cards in Canada only give you extended warranty and purchase protection, but this one comes with $100,000 in travel accident insurance.

- Amex privileges: Get access to Front of the Line Presale and Reserved tickets for concerts, theatre performances, movie screenings and other events.

Cons

- Redemption options: Your cash back rewards are applied once per year to your account as a statement credit every September. Compare this to cards that pay out quarterly or on demand.

- Bonus cap on groceries: You’ll only earn 2% on the first $15,000 spent annually on groceries (equal to $300 in cash back). After that, you’ll earn at the base rate of 1.25%.

- Amex acceptance: American Express is less widely accepted in Canada than Visa or Mastercard, so you might want to also carry a secondary card for purchases at certain stores, including Costco and Loblaws.

Runner-up for cash back: Tangerine Money-Back Credit Card

As the only card in Canada that lets you pick your bonus rate categories, the Tangerine Money-Back card is a perennial favourite among Canadians looking for a flexible no-fee card that fits their spending habits. Cardholders select two categories at a time from a list of 13 options and receive 2% cash back on purchases in those categories. Those with a Tangerine Savings Account can even unlock a third 2% cash-back category.

Tangerine Money-Back Credit Card

Annual fee: $0

- 2% in up to 2 categories of your choice (including groceries, gas and dining) or 3 categories if you deposit your Rewards into a Tangerine Savings Account and get a third 2% Money-Back category.

- 0.5% cash back on everything else

Welcome offer: Earn an extra 10% cash back during the first two months (up to $100 in cash back). Offer expires January 30, 2026

Card details

| Interest rates | 20.95% on purchases, 22.95% on cash advances and 22.95% on balance transfers |

| Income required | Personal or household income of $12,000 |

| Credit score | 660 or higher |

Pros

- Unmatched cash back flexibility: This is the only card in Canada that allows you to pick your own bonus categories and change them over time to reflect your evolving spending habits.

- 13 categories to choose from: Pick your two (or three) categories from a list that includes grocery, gas, restaurants, entertainment, public transit, and recurring bills. You can also switch bonus categories every 90 days.

- Easy redemption: Rewards are automatically deposited into your account monthly.

- Free additional users: Add up to 5 free authorized users and earn faster as a group.

- Low balance transfer interest rate: Transfer balances during the first 30 days and pay only 1.95% interest on the balance for the first 6 months (plus a 1% balance transfer fee).

Cons

- Limited insurance and perks: Only the most basic two coverages are included (purchase assurance and extended warranty) and extra perks are limited.

- Low base rate: Purchases that don’t fall into one of your chosen 2% categories will only earn 0.5% cash back.

- No physical branches: Tangerine does not have any physical locations, so you must be comfortable with online banking.

Best for travel: American Express Green Card

Earn points on everyday purchases and enjoy the flexibility of redeeming them for a variety of rewards with this no-fee credit card. Plus, Amex Membership Rewards are transferable at a 1:1 value to other frequent flyer and rewards programs, creating an opportunity to boost the value of your rewards.

American Express Green Card

Annual fee: $0

- 1 point for every $1 spent on all purchases

- 1 additional point for every $1 spent on hotel or car bookings made on americanexpress.ca.

Welcome offer: earn 10,000 Membership Rewards points when you charge $1,000 in purchases to your card in the first three months of cardmembership.

Card details

| Interest rates | 21.99% on purchases, and 21.99% on cash advances, penalty APR on purchases and cash advances (rates are variable) |

| Income required | None specified |

| Credit score | 725 or higher |

| Point value | 1 Amex Membership Rewards point = $0.01 when redeemed with the Flexible Points Travel Program, $0.015 on average with the Fixed Points Travel Program, and up to $0.02 with airline points transfers. |

Pros

- Strong earning potential: Earn a flat rate of 1 point per $1 on all purchases with no spending limits, and double for hotel or car rental bookings made through Amex Travel Online.

- Transfer points to increase value: When you transfer points to certain partner programs, like Aeroplan, you can double their value to 2 cents per point.

- Amex Membership perks: Take advantage of curated dining, shopping, and entertainment events with rewards like Amex Experiences, and get advance access to tickets with Front of the Line.

Cons

- No travel insurance or perks: You don’t get insurance or perks like free lounge access, but that’s not unusual for a no-fee card.

- Limited acceptance: American Express cards are accepted at many places at home and abroad, but there are limitations—you can’t use Amex at Costco or Loblaw banner stores, for example.

Best for no foreign exchange fees: Home Trust Preferred Visa

Did you know that every time you use your credit card outside of Canada, most card issuers charge a 2.5% foreign transaction fee for processing purchases made in a non-Canadian currency? The Home Trust Preferred Visa is the only no-fee credit card in Canada that doesn’t charge a forex fee. It also comes with a decent cash back earn rate on all purchases in CAD.

Home Trust Preferred Visa

Annual fee: $0

- 1% on all purchases in Canada

- Pay no FX fees on foreign currency purchases

Welcome offer: This card does not have a welcome bonus at this time.

Card details

| Interest rates | 21.99% on purchases, 21.99% on cash advances |

| Income required | None specified |

| Credit score | 660 or higher |

Pros

- Flat earn rate: Earn 1% cash back on everything you buy in Canadian dollars with no limits on how much you can earn.

Cons

- No cash back on foreign purchases: You won’t earn rewards on purchases made in a foreign currency, but the 2.5% saved on forex fees might be worth more than the rewards offered by another card.

- Annual redemption schedule: Cash back is only redeemed in January, rather than on demand throughout the year.

Best for low interest rates: Desjardins Flexi Visa

If you tend to carry a credit card balance from month to month, the smart financial move may be to prioritize low interest over chasing rewards. That’s where the Desjardins Flexi Visa comes in. It offers a low APR, making it the best credit card in Canada with no annual fee and low interest rates of 10.9% for regular purchases and 12.9% for cash advances.

Desjardins Flexi Visa

Annual fee: $0

Rewards: Does not offer rewards.

Welcome offer: None at this time.

Card details

| Interest rates | 10.90% on purchases and 12.90% on cash advances |

| Income required | Not specified |

| Credit score | Not specified |

Pros

- Lowest interest rate available: This card offers the lowest purchase APR of any no-fee card in Canada.

- Some travel insurance: You’ll get emergency medical, trip cancellation, and baggage coverage for up to three days—suitable for a weekend trip. Plus, the emergency medical coverage applies to travellers age 75 and under, whereas coverage stops at 65 with some cards.

Cons

- No balance transfer promotion: If your goal is to pay off a current credit card balance fast, consider a card with a balance transfer promotion instead. The Flexi Visa doesn’t charge a balance transfer fee, however, which is a plus for those who decide to transfer anyway.

- Limited in-person support: Desjardins only offers brick and mortar branches in Ontario and Quebec.

- Interest rates can increase: Read the fine print—Desjardins warns that if you don’t make your minimum payment by the due date, your 10.9% interest rate jumps to 19.9%.

Best for no credit checks: Home Trust Secured Visa

Canadians with low or no credit may want to consider a secured credit card, like the Home Trust Secured Visa. This card offers more flexibility than most secured credit cards by offering you two options: an interest rate of 19.99% with no annual fee, or a lower interest rate of 14.90% with a $59 annual fee. Home Trust reports payments to the credit bureaus, so using the card responsibly can help build or improve your credit score.

Home Trust Secured Visa

Annual fee: $0

Rewards: Does not offer rewards.

Welcome offer: None at this time.

Card details

| Interest rates | 19.99% on purchases and 19.99% on cash advances |

| Income required | None specified |

| Credit score | 300 or higher |

Pros

- Choice of two options: Pay an annual fee of $59 annual fee to save on interest with a 14.90% interest rate. Alternatively, you can get the same card for no annual fee, but with a higher interest rate.

- Reports to both credit bureaus: Home Trust reports your activity to both TransUnion and Equifax, which helps you build your credit rating if you pay your bills on time.

Cons

- High minimum deposit: You’ll need to deposit $500 upfront. Some issuers only require a $50 deposit.

- Not available in Quebec: Residents of the province aren’t eligible for this secured Visa.

To select the best cards, we only looked at no-fee credit cards, but we also considered the return on spending and weighed that against any annual fee. We also looked at other perks or benefits that made the cards stand out. The addition of links from affiliate partners has no bearing on the results in this ranking. Read more about the MoneySense selection process and about how MoneySense makes money.

Compare all no-fee credit cards

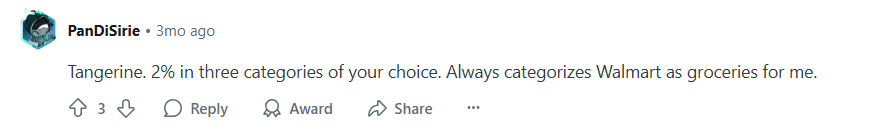

Reddit reviews: Canadians share their favourite no-fee credit cards

Now that you have some idea of what great no-fee credit cards look like, it can help to read up on what real cardholders recommend, so we turned to Reddit.

Of the cards on our list, Redditors really liked the Tangerine Money-Back card for its ability to adjust earning categories to naturally fit their spending habits.

As this user points out, don’t forget to consider income requirements when looking for cards.

Pros and cons of no-fee credit cards

No-fee credit cards might not be as popular as cash back or rewards cards, but they have several advantages (and some disadvantages).

Pros

- You don’t have to pay to use the credit card: If you have a card with an annual fee, you have to earn enough rewards just to cover the cost of using the card. No-fee cards don’t have that problem, so the rewards you earn go straight into your pocket, no matter how big or small.

- You might save on select fees or earn discounts: Some no-fee cards waive foreign transaction fees or include insurance coverage along with discounts, all of which could save you money.

Cons

- You won’t earn many rewards or cash back: Cards with no-fee aren’t as profitable for card issuers, so they aren’t as generous with cash back or rewards.

- You might not get much of a welcome offer: Sometimes, cards come with such great welcome offers that they offset the card’s annual fee. Again, since no-fee cards are essentially free, don’t count on welcome bonuses that rival those of premium cards.

- Your card will be pretty basic and lack perks: We’re really talking about insurance coverage, but you probably won’t see rewards like roadside assistance, concierge service, or airport lounge access, either.

When does a no-fee credit card make sense?

A no-fee credit card is a good option for someone who’s prioritizing saving and building a credit score rather than earning rewards or cash back.

Maybe you prefer making purchases with cash and just want a card for occasional online shopping or travelling. If you don’t think you’d get your money’s worth out of a card with a fee, a no-fee card is best.

It’s also a better choice for someone who might not meet credit score or income requirements of a rewards or cash back card (since these are usually considerable). Because no-fee credit cards are usually straightforward to use, these might make sense for someone who simply wants to track their spending.

How to choose the best no-fee credit card in Canada for you

First off, really consider if you want a no-fee card or if you don’t mind paying a fee (usually to get better perks, benefits, and rewards).

If you’re absolutely sure you want a no-fee card, choose the best card for you by asking yourself these questions:

- Does this card offer rewards?

- Is this an unsecured credit card or do I have to pay a deposit?

- What kind of insurance, if any, is included?

- Is this card issued by a bank I currently use?

- Do I meet eligibility requirements?

Find the perfect card with CardFinder

In under 60 seconds, get matched with a personalized list of the best credit cards based on your spending personality and approval likelihood. No SIN required.

Remember: Cards with no annual fee still have fees

One last thing to point out—just because a credit card has no annual fee doesn’t mean it has no fees at all.

No-fee credit cards still charge interest on purchases, balance transfers, and cash advances. And, you will be hit with fees if you miss payments or go over your credit limit. Unless specified, the card will also charge a standard 2.5% foreign transaction fee.

FAQs

A no-fee card is a great option if you don’t use a credit card very much or you’re still trying to build a credit score. This way, you’re not paying for the privilege of occasionally using a credit card.

Scotiabank offers five no-fee credit cards, including a Scene+ Visa, Scotia Momentum Visa, Scotiabank Amex, Scotia Momentum Mastercard, and Scene+ Visa for Students. None of them made our list of the best no-fee credit cards, but they’re still worth considering, especially if you already have a Scotiabank account.

There’s no specific requirement, since credit card use is personal. It’s a good idea to have at least one card in order to build your credit score and maintain a good credit mix, but you only need additional cards if they line up with your financial goals, such as saving or earning certain rewards.