House bidding wars move into the suburbs

Choosing between suburban and urban living is more than calculating what you'll pay for your house

Advertisement

Choosing between suburban and urban living is more than calculating what you'll pay for your house

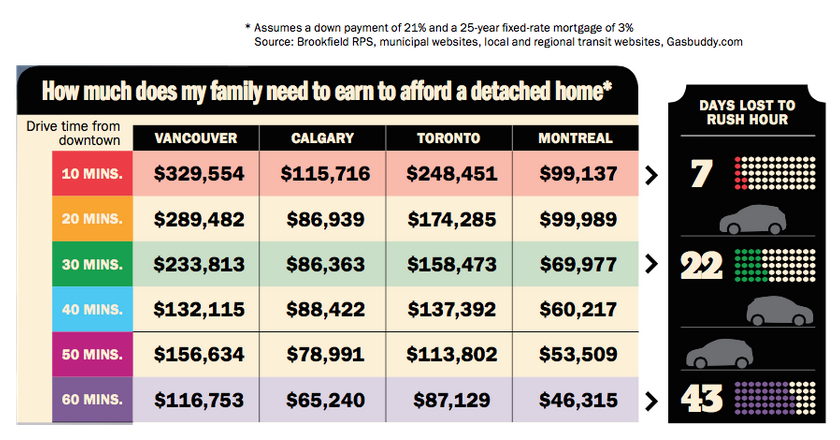

As they made one bid after another, they realized they had to spend a lot more. That meant a budget increase to $450,000, and she still felt priced out of her hometown and the surrounding area. “On one house we offered $105,000 over asking and didn’t get the house. The house went for $130,000 over asking,” she said. Like many first-time homebuyers, the Stoodleys had a condition of pending finance approval, something they weren’t comfortable removing even though in this market that one condition often meant the difference between getting a house and losing one.These days the question many first-time homebuyers are asking is: How to find a suburban home in today’s hot real estate market? Experts state that the steps are the same whether you’re bidding on an urban or a suburban home: get pre-approval financing in writing, know exactly what you want and be ready to move quickly. But there’s more to this decision. MoneySense examined the urban versus suburban trade-off when it comes to buying a home and discovered that while home prices are important, it’s not the only factor buyers must consider when opting for a suburban purchase. The time spent commuting, along with lifestyle preferences and proximity to amenities are all significant facets of this decision. While this decision is often framed as a trade-off—where one factor tips the scales over another— in reality, it’s more like finding a sweet spot, a delicate balance between cost and commuting time and how close you are to friends, family and amenities. Should I underprice my home to start a bidding war? » To help you decide if buying a suburban home is right for you and your family, MoneySense teamed up with real estate analysts Brookfield RPS to crunch the numbers and find out what it really means to own and live in a single-family detached home within or near each of Canada’s four largest cities: Vancouver, Calgary, Toronto and Montreal. Our analysis looks at detailed data on commute times, current average sale prices, living space and lot sizes—including a tricky calculation to tell us how much of a home’s value is currently locked into the land itself. Armed with this data, we can tell you just how much home and property you can expect to find the further you drive from downtown. Moreover, we can tell you how much it actually costs to live the further into the suburbs you get. For instance, did you know your household needs to earn $248,000 each year to afford a detached home in downtown Toronto? Move 30 minutes away (an hour each way in rush-hour traffic) and the income required to afford a detached home drops to $158,000 per year.

For more on finding your urban-suburban sweet spot, check out our report: City or Suburbs: Where can you afford to live?

Read more from Romana King at Home Owner on Facebook »

For more on finding your urban-suburban sweet spot, check out our report: City or Suburbs: Where can you afford to live?

Read more from Romana King at Home Owner on Facebook »

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email