Do BoC rates impact you? 10 questions answered

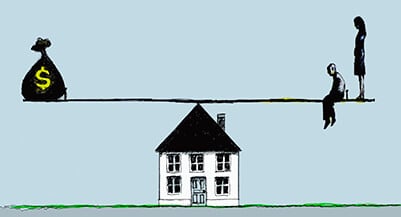

Why you should care about whether or not the Bank of Canada holds rates steady

Advertisement

Why you should care about whether or not the Bank of Canada holds rates steady

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email